10 most frequent scams released for Mississauga, Brampton, Hamilton and across Canada

Published December 6, 2022 at 10:54 am

Canadians lost more money to scams in 2021 than in any other previous year.

In total, $379 million was reported in fraud losses in 2021, which is 130 per cent more than 2020 and is the highest total reported annual losses in the Canadian Anti-Fraud Centre’s history, according to the Centre’s latest report.

The Canadian Anti-Fraud Centre is the primary repository for fraud information and intelligence in Canada, and is a partnership jointly operated by the Royal Canadian Mounted Police (RCMP), the Ontario Provincial Police (OPP) and the Competition Bureau of Canada.

People in Mississauga, Brampton, Hamilton and beyond may have noticed more scams coming in via texts but the fraudsters are targeting victims in several different ways.

“Canadians are being targeted and victimized by telephone calls, emails, social media posts, advertisements, and fraudulent websites by diverse and coordinated fraudsters and cybercriminals,” the report notes.

“Technological development has allowed for the monetization and transfer of personal information, creating challenges for individuals seeking to protect themselves from identity theft and fraud.”

Globally, Canadians rank near the top in terms of length of time spent online and are putting more personal information online than ever before, the report continues.

“While this trend can be partially attributed to the ongoing COVID-19 Pandemic, the digital environment is expected to continue growing,” the report notes.

There is also a sharp increase in the use of cryptocurrency in frauds — the report notes a 238 per cent increase from 2020 to 2021 in this type of investment fraud.

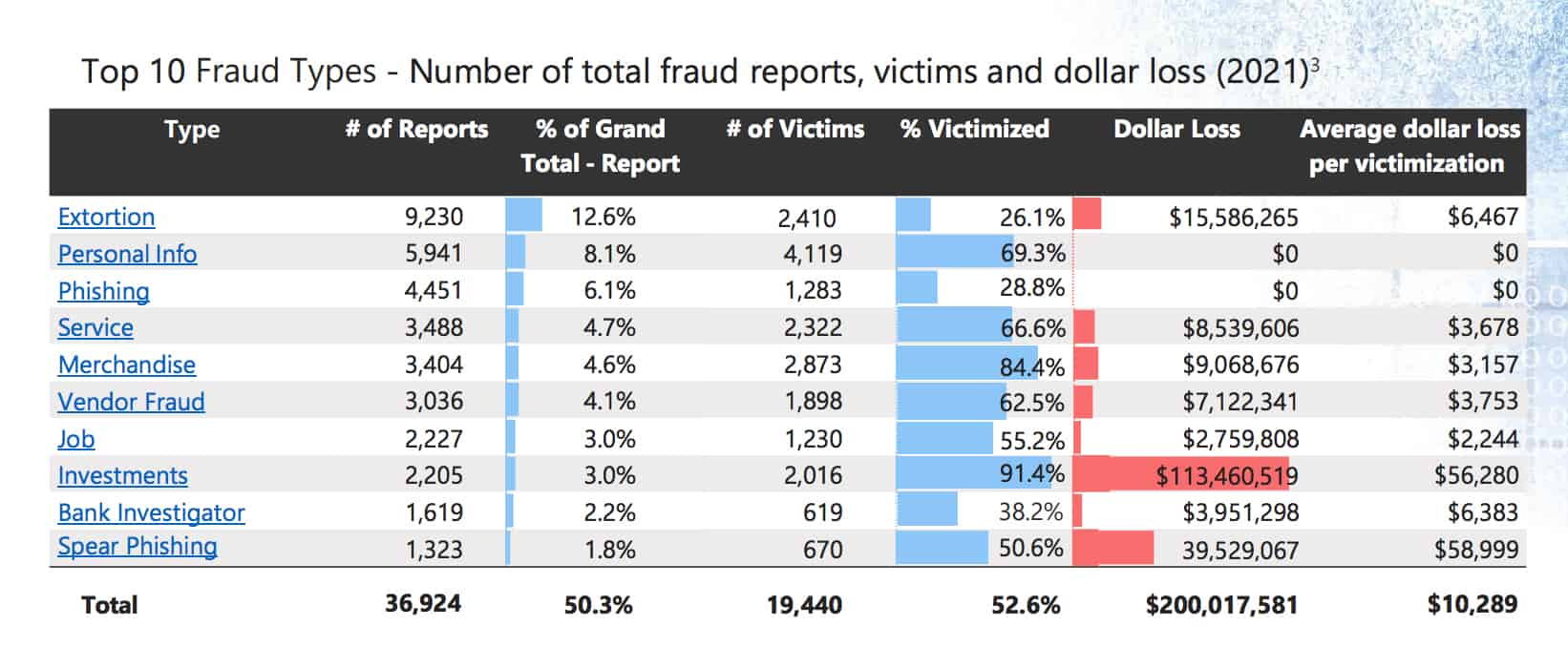

The Canadian Anti-Fraud Centre top ten frauds in 2021 are:

Extortion – This scam involves obtaining money, property or services from a person or institution through coercion. One recent example is a call or text claiming that you have been exposed to monkeypox.

Personal Information – A scammer pretends to be from a business, government agency, bank, or utility company, and urgently asks you to verify your personal information. An example was an October scam from someone claiming to be looking for assistance for Hurricane Fiona flood victims.

Phishing – Criminals use tactics to trick you into giving personal information or clicking on links. A recent example is a text message from someone claiming to be from the Canada Revenue Agency.

Service – This scam involves someone offering services such as air duct cleaning, cellphone services or an immigration website. In some cases, the scammer does provide the service but it is low quality. In other cases, the scammer is trying to gain access to your device.

Merchandise – These scammers create fake ads online purporting to sell goods. People send money for things such as a puppy, rentals, clothing or event tickets but never get the pet or items.

Vendor fraud – This is when an ad that you have posted gets a response from a scammer. They claim to be located out of town and offer to buy the item unseen. When it comes time to pay, they use various tactics to scam you and avoid paying.

Job – Many scams target and take advantage of people looking for a job. Often, the scammer will direct the victim to receive e-transfers or wire transfers from clients into their own bank account.

Investments – An investment scam is any solicitation for investments into false or deceptive investment opportunities. These opportunities falsely promise higher-than-normal returns. Links or download attachments in these text messages or e-mails can contain viruses or malware.

Bank investigator – A scammer calls to ask for help to catch a bank employee who has been stealing money or claims to be helping you resolve suspicious transactions on your bank account.

Spear phishing – Spear phishing scams involve scammers pretending to be from legitimate sources to convince businesses or individuals to send them money. A recent example was a scammer impersonating an RCMP officer.

Read the entire report here.

INsauga's Editorial Standards and PoliciesThe CAFC 2021 Annual Report is here. Access the Report to learn more about the fraud and cybercrime landscape in Canada and trends observed by the CAFC during a historic year for reported fraud losses: https://t.co/hvfZEshJ3s #kNOwfraud #showmetheFRAUD #BeScamSmart pic.twitter.com/DGZQSDOMxz

— Canadian Anti-Fraud Centre (@canantifraud) December 5, 2022