The most expensive cities in Ontario and Canada to buy a condo

Published February 20, 2024 at 4:24 pm

The landscape of home ownership in Canada has without a doubt seen some drastic shifts over the years, and Ontario is no exception. Interest rates, high borrowing fees and an overall cost of living crisis have sabotaged many people’s dreams and even more down payments.

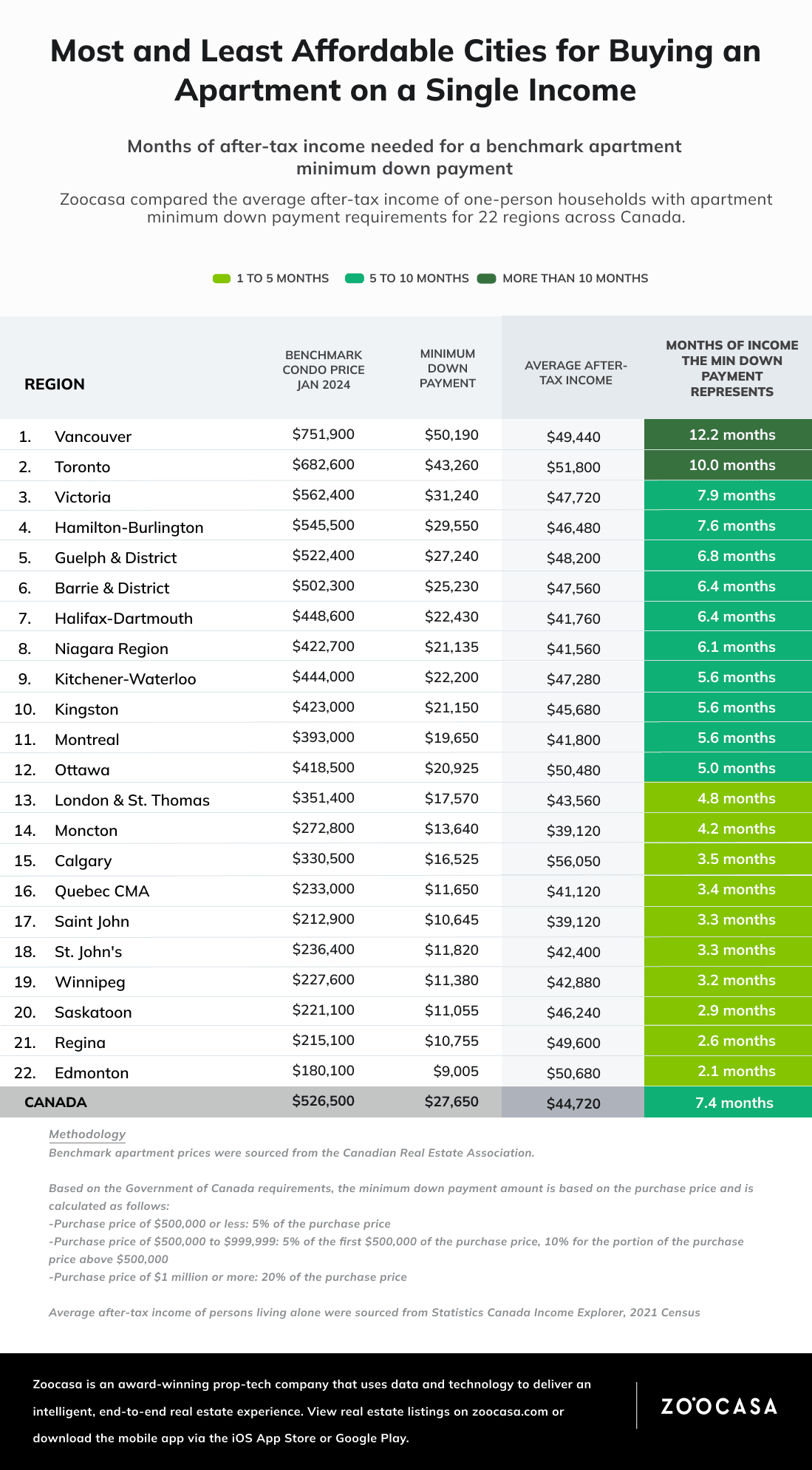

However, certain property authorities are taking it upon themselves to quantify the relationship between property, payments and time spent when it comes to acquiring a new condo in Canada. A recent study conducted by Zoocasa — a Toronto-based listing agency — has calculated the costs of buying a condo on a single-income basis in cities across the country.

The result, however, is not pretty, as numerous municipalities in Ontario make it to the top of the chart in terms of expenses.

Toronto naturally tops the chart as the most expensive place to secure a condo in Ontario and the second most expensive place in Canada, with a minimum down payment of more than $40,000. The benchmark price of a Toronto condo was $682,600 in January 2024, which means a single buyer would need to save for 10 months, as dictated by the survey.

Second place for out-of-pocket provincial pricing goes to the Hamilton-Burlington area where the benchmark price of a condo is $545,500. With a minimum down payment being close to $30,000, the time to make such a payment on the average salary is close to eight months for a single individual.

Third Place goes to Guelph and its surrounding areas, with the minimum down payment hovering around $27,000 and the time to build it on a single income being over six months. Condos in the area hit a benchmark price of $522,400 last month.

Honourable mentions also go to Barrie, Niagara and the Kitchener/Waterloo area, with all three areas having an average down payment of over $20,000 and a savings timeline of roughly six months.

While prospects for condo ownership in Ontario may be bleak, home-owning hopefuls can always look to Alberta, with downpayments in Edmonton (the lowest city on the national list) only being $9,000.

INsauga's Editorial Standards and Policies