Promise tracker Aug. 23: What the parties are pitching on the campaign trail

Published August 23, 2021 at 1:55 pm

OTTAWA — A running list of specific promises announced by the Liberals, Conservatives, NDP and Green party since the official start of the federal election campaign on Aug. 15.

Liberals

Aug. 22: Facilitate the hiring of 7,500 family doctors, nurses and nurse practitioners with $3 billion over four years. Put $6 billion to help eliminate health system wait lists. Provide $400 million over four years to expand virtual health services.

Aug. 20: Introduce 10 days of paid sick leave for federally regulated workers. Put $100 million toward school ventilation improvements. Provide $100 million to the Canada Healthy Communities Initiative, including $70 million for increasing indoor ventilation. Introduce a tax credit for small businesses to invest in better ventilation.

Aug. 19: Train up to 50,000 new personal support workers. Guarantee a minimum wage of $25 an hour for PSWs. Double the Home Accessibility Tax Credit. Develop a Safe Long Term Care Act. Give provinces and territories $3 billion in funding to address quality and capacity in long-term care.

Aug. 18: Funding to train 1,000 community-based firefighters and to purchase related equipment. Would also help Canadians make their homes more resilient against climate change, through retrofits and upgrades.

Aug. 17: Reduce fees for child care by 50 per cent on average in the next year and deliver $10-a-day on average child care within five years everywhere outside of Quebec.

Aug. 16: Extend the Canada recovery hiring program to March 31, 2022. Provide the tourism industry with temporary wage and rent support of up to 75 per cent. Launch an arts and culture recovery program that will match ticket sales for performing arts, live theatres and other cultural venues to compensate for reduced capacity. Extend COVID-related insurance coverage for media production stoppages. Implement a transitional support program for workers from the creative industry.

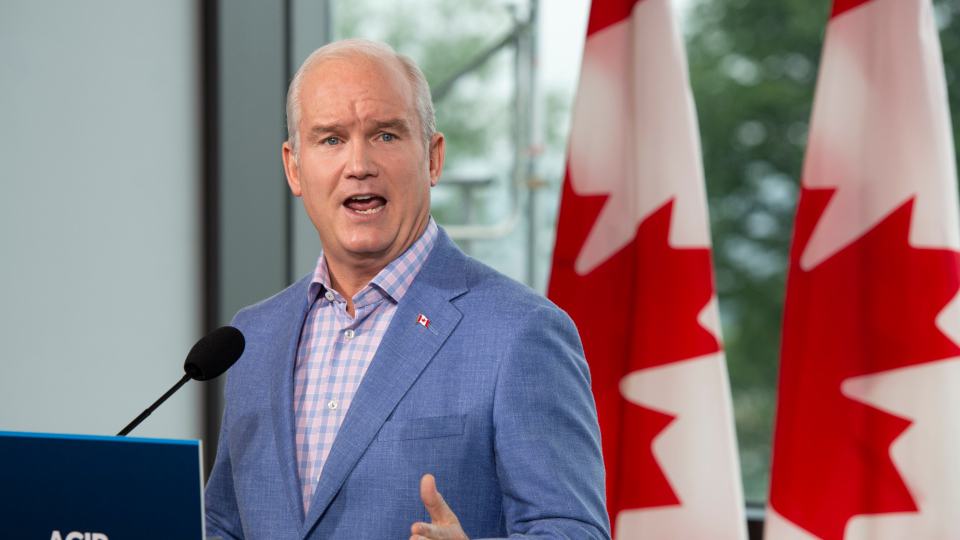

Conservatives

Aug. 23: Require federally regulated employers with more than 1,000 employees or $100 million in annual revenue to include worker representation on their boards of directors.

Aug. 22: Invest $325 million over three years to create 1,000 residential drug treatment beds and build 50 recovery community centres. Enhance culturally appropriate addiction treatment and prevention in First Nation communities. Provide $1 billion over five years for Indigenous mental health and drug treatment programs.

Aug. 21: Double the Disability Supplement in the Canada Workers Benefit. Provide an additional $80 million per year through the Enabling Accessibility Fund. Reduce the number of hours required to qualify for the Disability Tax Credit and the Registered Disability Savings Plan. Overhaul disability supports and benefits.

Aug 20: Pay a 25-per-cent subsidy for all net new hires for six months, with up to an additional 25 per cent top-up depending on if the worker had been unemployed for several months.

Aug. 19: Build one million homes over three years. Ban foreign investors who live outside the country from buying property for at least two years, while encouraging foreign investment in affordable purpose-built rental housing. Release at least 15 per cent of the government’s real estate portfolio for homes. Require municipalities receiving federal funding for public transit to increase density near that transit. Allow the deferral of capital gains tax when selling a rental property.

Aug. 18: Pass an Anti-Corruption Act to strengthen federal legislation on ethics, lobbying, and transparency. The act would feature increased fines for ethical violations, prevent members of Parliament from collecting speaking fees and create financial penalties for any violation of the Conflict of Interest Act.

Aug. 17: Implement a month-long “GST holiday” in December, in which all purchases made at retail stores would be tax free.

Aug. 16: Balance the budget by 2031.

Recover one million jobs lost during the pandemic. Pay up to 50 per cent of the salary of new hires for six months after the Canada Emergency Wage Subsidy ends. Provide a five per cent investment tax credit for any capital investment made in 2022 and 2023. Provide a 25 per cent tax credit on amounts of up to $100,000 that Canadians personally invest in a small business over the next two years. Provide loans of up to $200,000 for small and medium businesses in the hospitality, retail and tourism sectors, with up to 25 per cent forgiven.

Accelerate domestic development and production of vaccines. Prioritize the signing of contracts for booster shots. Deploy rapid testing at all border entry points and airports to screen new arrivals.

Scrap all Liberal government childcare funding deals with the provinces and territories and provide a refundable tax credit covering up to 75 per cent of the cost of child care for lower-income families.

Introduce the Canada Seniors Care benefit, paying $200 per month per household to any Canadian who is living with and taking care of a parent over the age of 70.

Double the Canada Workers Benefit up to a maximum of $2,800 for individuals or $5,000 for families and pay it as a quarterly direct deposit. Launch a “Super EI” that temporarily provides more generous benefits when a province goes into recession. Increase EI sickness benefits to 52 weeks for those suffering from a serious illness.

Build one million homes in the next three years.

Scrap the carbon tax in favour of a “personal low carbon savings account.”

Meet with the premiers within the first 100 days of forming government to propose a new health agreement that boosts the annual growth rate of the Canada Health Transfer to at least 6 per cent.

Aug. 15: Require unvaccinated Canadian passengers to present a recent negative COVID-19 test result or pass a rapid test before getting on a bus, train, plane, or ship. Require federal public servants who aren’t vaccinated to pass a daily rapid test.

NDP

Aug. 23: Identify and eliminate subsidies to oil and gas companies and reallocate the money to the renewable energy sector. Cut Canada’s emissions by more than half by the year 2030, such as through electrifying public transit. Put $500 million in funding to support Indigenous-led stewardship programs.

Aug. 22: Change the name of the Toronto-Danforth riding to Danforth-Layton.

Aug. 21: Tighten the rules to prevent developers from “renovicting” families. Provide help of up to $5,000 a year for families’ rents while tackling wait lists for affordable housing.

Aug. 20: Appoint a special prosecutor on residential schools. Demand all residential school records from institutions such as governments and churches be released. Work to fully implement all outstanding recommendations from the Truth and Reconciliation Commission.

Aug. 19: Create a $250 million Critical Shortages Fund to help train and hire 2,000 nurses. Ensure that provinces commit funding specifically for health-care workers.

Aug. 18: A 20 per cent foreign homebuyers’ tax along with the construction of 500,000 affordable housing units in the next decade. The tax would apply to the purchase of homes for those who are not Canadian citizens or permanent residents.

Aug. 17: Expand domestic manufacturing capacity and invest in small businesses.

Aug. 16: Take back money from CEOs who received federal subsidies intended for protecting workers’ jobs and redirect it to supports for families.

Greens

Aug. 16: End the construction of new pipelines, fracking, and oil and gas exploration.

This report by The Canadian Press was first published Aug. 23, 2021.

The Canadian Press

INsauga's Editorial Standards and Policies