New CRA tax return scam hits Mississauga and Brampton

Published March 18, 2023 at 10:13 am

With tax season here, fraudsters are taking the opportunity to target Mississauga and Brampton residents with their latest text scam, impersonating the Canada Revenue Agency.

As residents prepare to file paperwork hoping to receive a return rather than owe the government — a new scam can fool you into believing you have funds waiting to be collected.

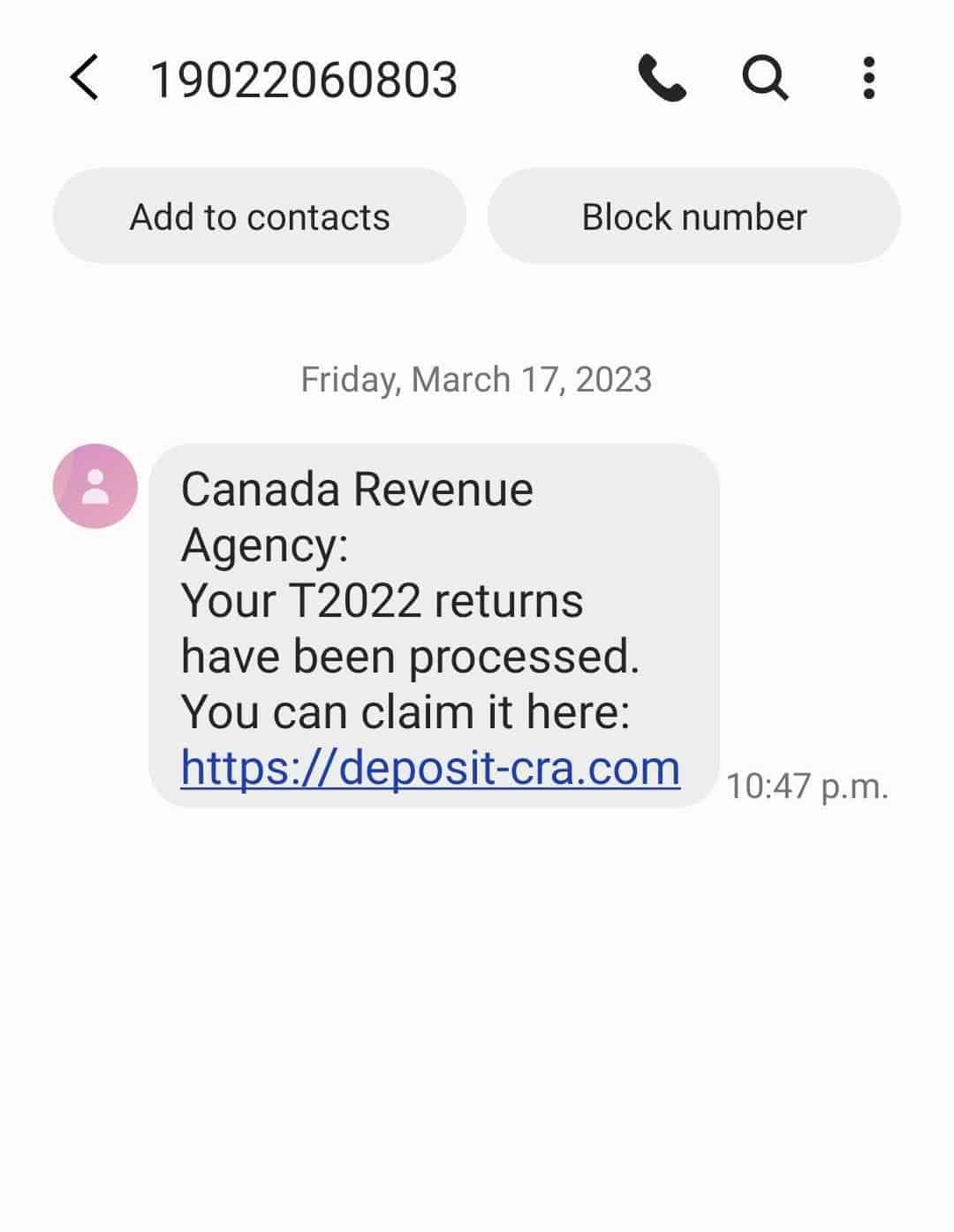

The text informs the recipient that their T2022 has been processed and prompts the person to click on the provided link to claim their money.

Below is an example of what the text may look like:

Residents are warned that this message, and any similar message offering a return or refund, is in fact fraudulent.

“Do not reply to the text message or send them any personal information. The CRA will not use text messages or instant messages to start a conversation with you about your refund,” according to the CRA.

Text scams are becoming one of the most common methods scammers use to connect with their victims.

Last month (February 2023) the popular Costco Wholesale company was the pawn used to fraud members into believing they have received their annual 2% rewards. All the recipient had to do was Reply ‘Y’ to the text for details.

For a frequent Costco shopper, that kind of cashback can be too hard to resist and would be beneficial on their next visit to the store. However, replying to the message would lead them to more losses than gains.

The Canadian Anti-Fraud Centre, which keeps tabs on major scams and fraud incidents, advises residents to never share personal information with unverified people or groups.

That includes information such as your name, address, birth date, social insurance number, and credit card or banking information.

More fraud prevention tips related to tax payments can be found on the CRA’s website.

INsauga's Editorial Standards and Policies