Mississauga one of the top 5 cities leading the nation in high rents

Published February 20, 2020 at 7:01 pm

If you’re having trouble finding an affordable rental in Mississauga, you’re not alone–and it doesn’t look like relief is coming anytime soon.

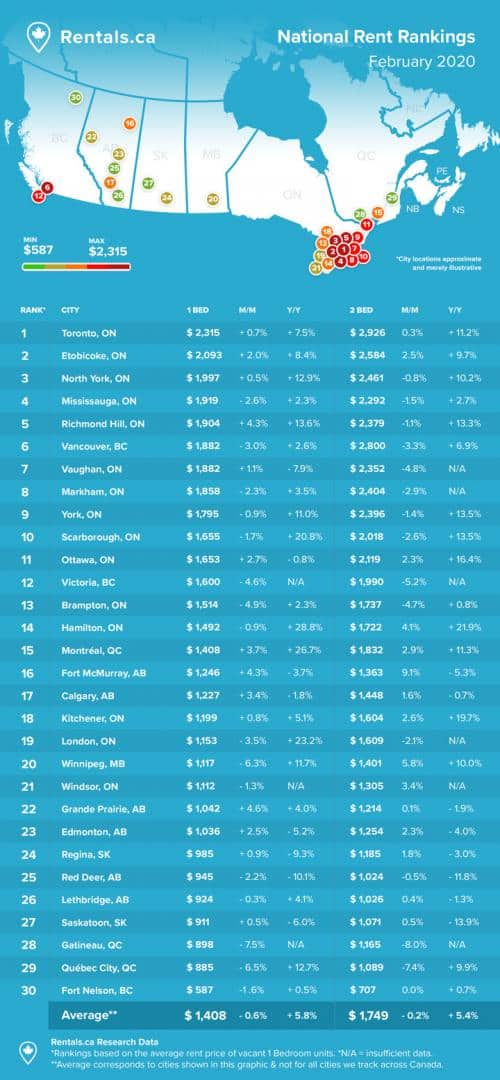

Mississauga finished fourth in average monthly rent for a one-bedroom home in January at $1,919 and ninth for average monthly rent for a two-bedroom at $2,292, according to the February National Rent Report from Rentals.ca and Bullpen Research & Consulting.

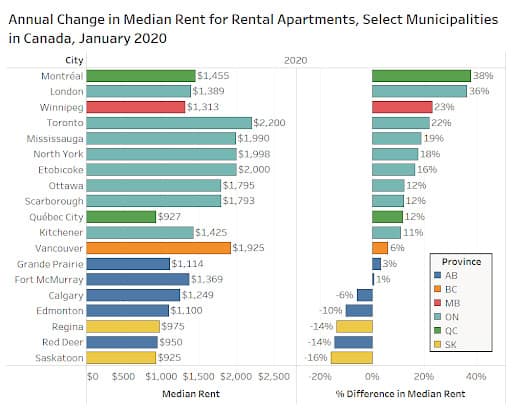

The report says that the year-over-year median rent for rental apartments in the city is up a whopping 19 per cent.

Not surprisingly, the GTA continues to lead the nation in high rents with nine of its municipalities landing in the top 10 for most expensive rents in January in Rentals.ca’s latest report.

When it comes to expensive rentals, Toronto leads the pack. A one-bedroom apartment costs $2,315 and a two-bedroom home costs $2,926.

Other areas in the top 10 include Etobicoke, North York, Richmond Hill, Vaughan, Markham, York, and Scarborough.

Brampton is also expensive, as the city finished 13th for average monthly rent for a one-bedroom at $1,514 and 14th for average monthly rent for a two-bedroom at $1,737.

Mississauga wasn’t the only city to record double-digit growth in year-over-year rental prices. Six other Canadian cities affected by such climbs include North York at 18 per cent; Etobicoke at 16 per cent; Ottawa at 12 per cent; Scarborough at 12 per cent; Quebec City at 12 per cent, and Kitchener at 11 per cent.

The report says that four Canadian cities actually witnessed double-digit decreases, including Saskatoon, which was down 16 per cent; Red Deer, which was down 14 per cent; Regina, which was down 14 per cent and Edmonton, which was down 10 per cent.

Another up and coming city is getting more expensive. Average monthly rent for a one-bedroom and a two-bedroom home have risen 28.8 per cent and 21.9 per cent respectively in Hamilton, according to listings data on Rentals.ca.

As far as other interesting trends go, Rentals.ca partner Local Logic found many millennial families want more than anything to live near a quality school.

“As more families continue to rent as opposed to buy, we see renters for larger homes are willing to sacrifice their ability to take transit or walk to get their groceries in favour of being near a quality school,” said Vincent-Charles Hodder, CEO of Local Logic, in a news release.

“We expect the rental markets to perform strong in areas close to schools in 2020.”

On an annual basis, average rents for all property types are up just 1.3 per cent across Canada. However, the report says that for rental apartments, year-to-year rent has grown 5 per cent in Canada, rising from $1,463 per month to $1,536 per month.

“Annual growth in the average rental rate nationally cooled off in January, despite major rent increases in a number of municipalities in Canada,” said Matt Danison, CEO of Rentals.ca.

“Some rental demand is shifting to the resale market as we are recovering from the stress test’s credit tightening, and the fear of interest rate hikes. This shift is also affecting the high-end rental market, as households choose to buy instead of considering these units.”

According to the report, rental apartments in Canada have seen rents per square foot increase by 6.8 per cent annually from $1.89 per square foot in January 2019 to $2.02 per square foot in January 2020.

The average unit size has declined by 20 square feet year-over-year to 810 square feet, but the report notes that smaller units typically have higher per-foot rental rates.

The report says that average rental rates in Ontario continue to outpace the other major provinces in Canada, with an average rent of $2,290 per month recorded in January 2020, a 6 per cent increase year over year.

“The strong rent growth in Quebec and Ontario is enticing developers to build more apartments,” said Ben Myers, president of Bullpen Research & Consulting.

“According to Canada Mortgage & Housing Corporation, there were more rental starts than condo starts in January in both provinces. This supply is much needed to satisfy the increasing tenant demand, as the flattening out of condo rental rates could negatively impact investor activity and reduce secondary market supply.”

The National Rent Report charts and analyzes monthly, quarterly and annual rates and trends in the rental market on a national, provincial, and municipal level across all listings on Rentals.ca for Canada.

INsauga's Editorial Standards and Policies