Mississauga and Brampton have higher property taxes than most municipalities in the GTA

Published November 10, 2022 at 9:13 am

Buying a new home comes with more financial considerations than just the purchase price.

Mississauga and Brampton home prices are coming down. The average price of all property types in Mississauga went down to $987,356 in October – a little below the $1,032,889 price point seen in September 2022.

In Brampton, the average home selling price was $1,089,428 in October 2022, which is a 5.7 per cent drop from October 2021. But only down only 0.4 per cent from August, according to Zoocasa.

Nearby Milton has similar home prices — around $1.03 million, down by $136,378 from this time last year.

But buyers have to factor in other costs to owning a home including mortgage interest rates (which are high now) and property taxes.

“Paying property taxes is a financial obligation for all homeowners in Ontario and can cost you thousands of dollars, so it’s important to understand how they may impact your household’s bottom line,” notes a report from Zoocasa.

How much property tax residents pay is determined by the municipality tax rates and the home’s most recent value assessment from the Municipal Property Assessment Corporation (MPAC). Homeowners can calculate their property tax by multiplying the most recent home value assessment by the residential rate set by the municipality.

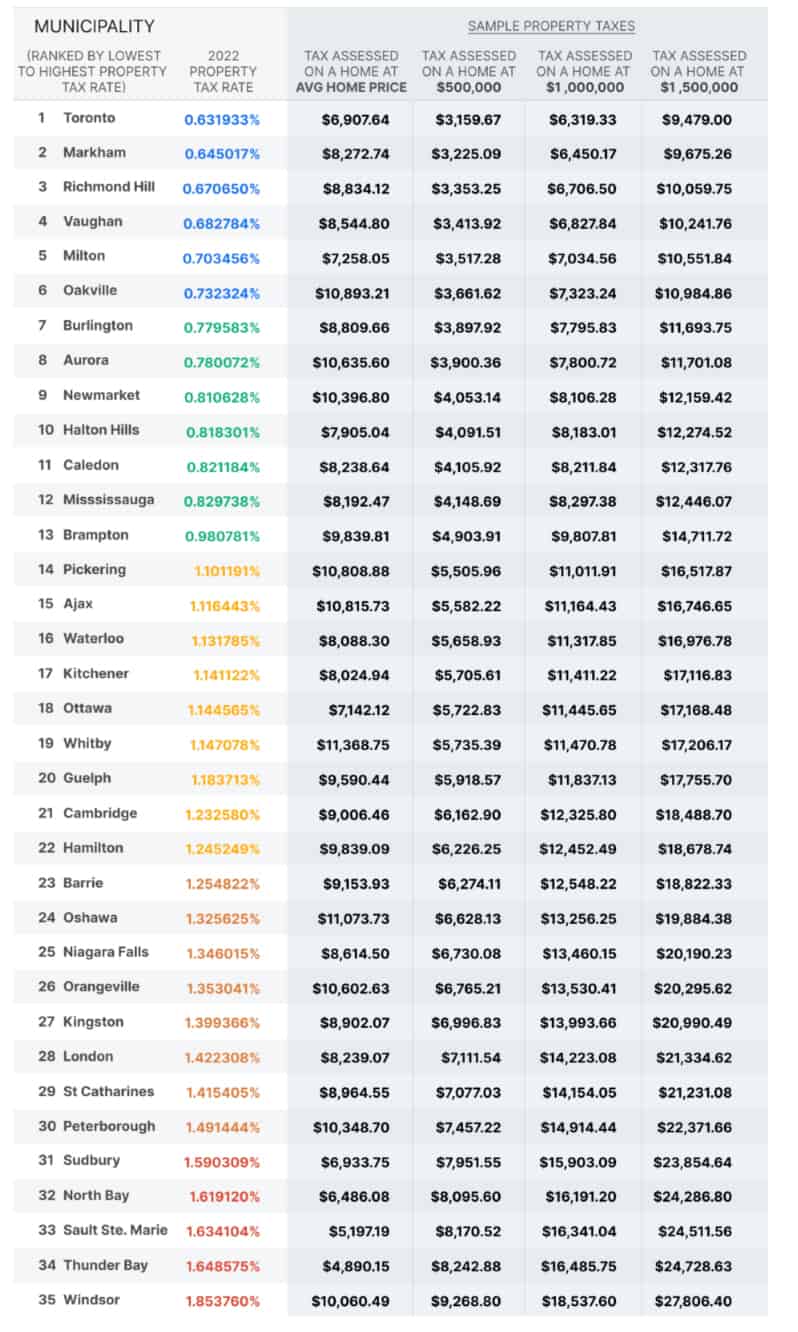

Mississauga and Brampton property tax rates are higher than most communities in the GTA, according to Zoocasa. The real estate brokerage ranked 35 Ontario cities on their property taxes. Mississauga ranked 12th with a rate of 0.829738 per cent, and Brampton is 13th at 0.980781 per cent.

Higher real estate prices and larger populations tend to mean lower property tax rates, due to the higher number of taxpayers helping to fund the city’s pot and bump the operating budget, Zoocasa notes.

But Mississauga is the second largest city in the GTA and it has one of the highest property tax rates. Toronto has the lowest tax rate at 0.631933 per cent. But nearby communities of Milton, Oakville, Burlington, Halton Hills and Caledon all have lower tax rates than Mississauga and Brampton.

The city with the highest tax rate in Ontario is Windsor.

Something to think about when you are choosing a home.