Latest job recruitment scam makes its rounds in Ontario

Published December 21, 2023 at 10:08 pm

With the holidays upon us and the end of the year just around the corner, individuals facing layoffs or financial struggles may encounter a glimmer of hope in unsolicited job offers. Yet, it’s crucial to remain vigilant as these emails, text messages, or phone calls could be another deceptive ploy devised by scammers.

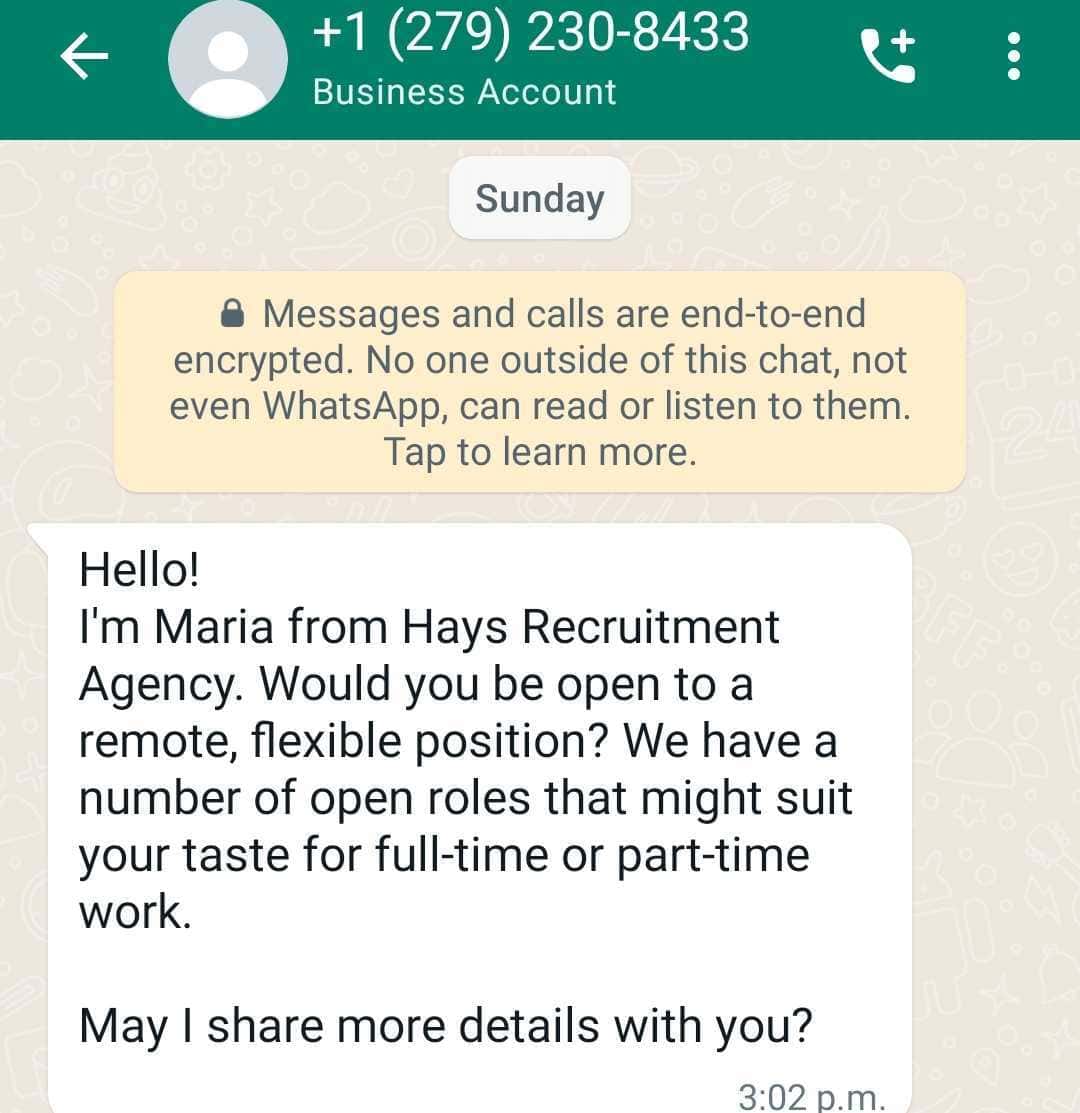

In this recent scam, fraudsters will use the WhatsApp messaging platform to approach potential victims. Operating under fictitious names, the scammers adopt a friendly demeanour, claiming to be from a recruitment agency. Adding a layer of deception, they will often use names of legitimate companies, misleading individuals into believing the job offer is genuine.

In this scenario, “Hays Recruitment” is in fact an employment agency based out of Toronto. However, it may be important to note the phone number in which the message is being delivered from.

The 279 area code is associated with Sacramento, California in the United States. Individuals who might choose to do a quick search online will easily figure out that they are being duped.

The message then asks the victim if they would be open to a remote job where many roles are available including part-time and full-time positions. This enticing offer might make the individual feel that they have a chance at filling the role.

According to the Canadian Anti Fraud Centre (CAFC) fraudsters will exploit real businesses, luring victims with freelance job opportunities to promote products, apps, or videos using software they’ve developed.

Once a victim installs the software and creates an account, they’re assigned “orders” or “tasks” to complete. To deceive victims further, they may receive a modest payment or commission, making it seem like the job is “real.”

The CAFC says, since Aug. 25 (2023) the company has seen an increase in these job opportunity scams.

Here are some of the common scams as outlined by the CAFC:

- Counterfeit Cheque—in this scam, fraudsters target individuals who post resumes online, offering various job opportunities such as caregiver, administrative assistant, and data entry clerk. They will follow-up by sending a fake cheque, accompanied by a fabricated story and will request the recipient to cash it. They will also ask for a portion of the funds to be returned back to the fraudster.

- Mystery Shopper—under the guise of various roles such as mystery shopper, quality control officer, client service strategist, or personal assistant, scammers will dispatch notices along with a cheque and instructions. The victim will be asked to deposit the funds into a personal bank account and transfer a substantial amount to a specified account. Additionally, fraudsters may request the victim to purchase gift cards, and provide them the numbers (found at the back of the card) for validation purposes. Throughout the process, the scammer will prompt the victim to submit customer service surveys, making it seem like a legitimate job. Eventually, the victim will discover that the deposited cheque was counterfeit, leaving them in debt to the bank.

Though crimes of this nature will never completely go away, as of June 30 (2023) there’s been a notable decrease in reported incidents.

These numbers reveal a significant decline from 92,078 reported cases in 2022 to 32,458, showcasing a 65% reduction.

Victims of fraud have also seen a substantial drop from 57,578 in 2022 to 21,299, representing a 63% decrease.

Financial losses due to fraud have also decreased from $531 million in 2022 to $283.5 million, indicating a 47% improvement.

The CAFC continues to advise residents to never share personal information with unverified people or groups. That includes information such as your name, address, birthdate, social insurance number, and credit card or banking information.

Additionally, individuals should block the number and avoid responding to the message as it could lead to a scammer getting a hold of important personal information.

INsauga's Editorial Standards and Policies