It could take half a century to save for a house down payment in Canada’s most expensive markets

Published March 12, 2024 at 11:33 am

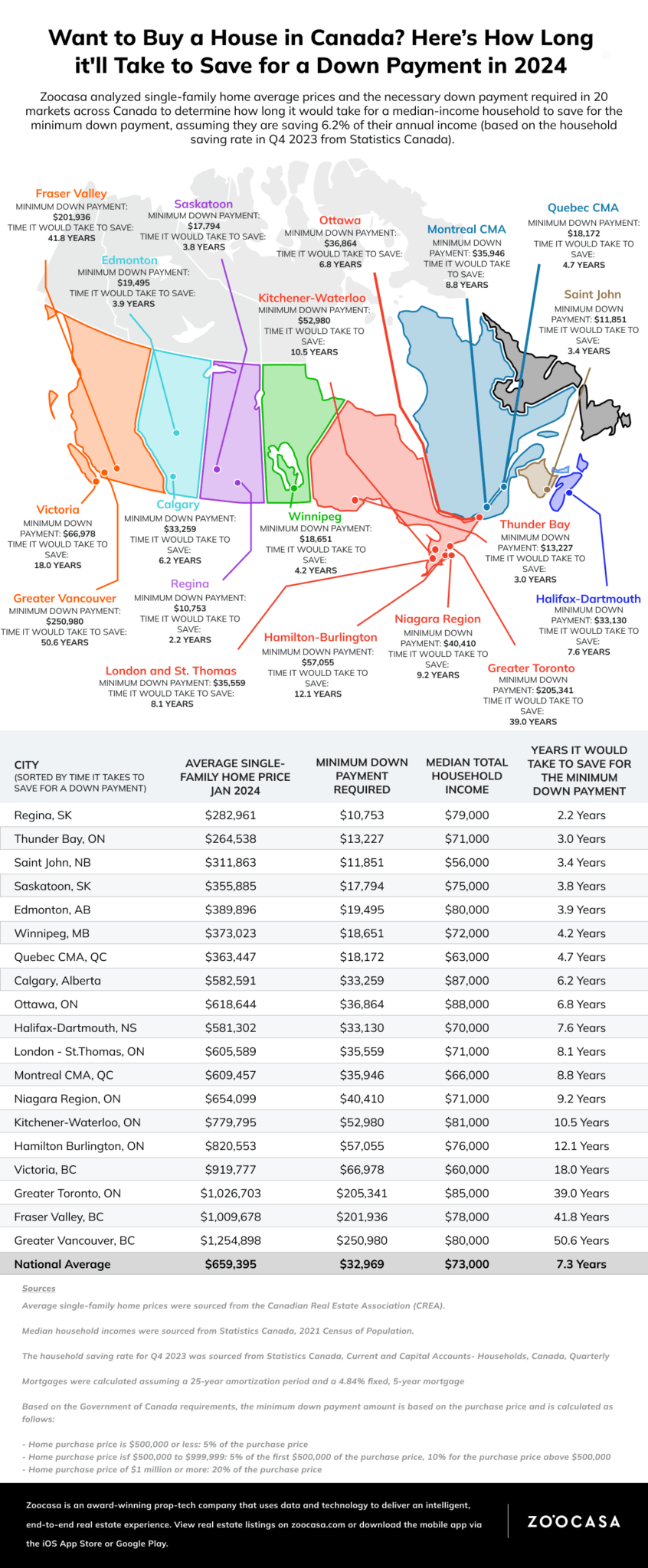

In some of Canada’s most expensive real estate markets, you may be a senior citizen before you can afford a single-family home.

In the most expensive cities, it would take 40 to 50 years to save for a down payment on a detached home but there are places where it could take less than three years.

In a new report, real estate platform Zoocasa analyzed housing markets in 20 major cities across Canada, calculating the required down payment for each.

They then determined how long it would take for a median, post-tax income household to save for the minimum down payment on a single-family home, using Statistics Canada data, and assuming a savings rate of 6.2 per cent of their annual income.

Two places come up at the top of the list for the shortest time to save for a single-family home.

In Regina and Thunder Bay, you can “turn homeownership dreams into reality faster than anywhere else in Canada,” the report finds.

In about two years and two months, a household earning the median income may be able to secure the minimum down payment for an average single-family home priced at $282,961 in Regina, the report notes.

Regina’s housing market offers some of the most budget-friendly options nationwide, with prices a staggering 57 per cent below the national benchmark. Plus, with a median post-tax household income of $79,000 — living in Regina means you’re getting a great deal while still earning more than some other Canadians.

The average price for a single-family home is less in Thunder Bay at $264,538 — 60 per cent lower than the national average. But the median income is lower, according to Zoocasa’s calculations. By setting aside around six per cent of their salary, people could make the minimum down payment in three years in Thunder Bay.

Saint John, New Brunswick is the third most affordable city. The report estimates it would take about three years and four months of saving on the median income. The median income is around $56,000 in Saint John, about 23 per cent lower than the national median income, but home prices are 52 per cent lower than the national average.

In Edmonton and Saskatoon, potential homeowners would require just under five years of savings for a down payment. Edmonton boasts a median salary of $80,000 and a single-family home averages around $389,896.

“The high salaries and low home prices allow many people to have the opportunity to own a home in the beautiful city,” the report notes.

With an average income of $75,000, Saskatoon residents could save about $3,825 annually and it would take about four years and seven months to save for a home priced at $355,885 – the second most affordable city in Saskatchewan. The minimum down payment is $17,794.

For those who don’t want to leave Ontario, aside from Thunder Bay, homeownership seems most affordable in the London and St. Thomas area where it would take about eight years to save.

In London and St. Thomas, home prices are eight per cent below the national average. Saving for the required down payment of $35,559 on a median household post-tax income of $71,000 will equate to just over eight years and one month, Zoocasa found.

And in the Hamilton-Burlington region, a person will require a little over 12 years to save a minimum down payment of $57,055.

Following a similar savings plan of six per cent of median post-tax income, it would take about 39 years to save a minimum down payment of $205,341 in much of the Greater Toronto Area.

But the most shocking amount of time to save is in the Great Vancouver area where the report suggests it would take 50 years and six months to save for the huge down payment required of $250,980.

Of course, there is also the option of buying a condo or attached townhome to build equity and save for down payment funds faster.

See the full report here.

Lead photo: Google Maps

INsauga's Editorial Standards and Policies