House prices still soaring as supply dwindles in Mississauga

Published February 6, 2020 at 6:52 pm

It looks like the wildly challenging market of 2017 is back, as house prices are increasing as fewer and fewer homes hit the market in Mississauga and the GTA overall.

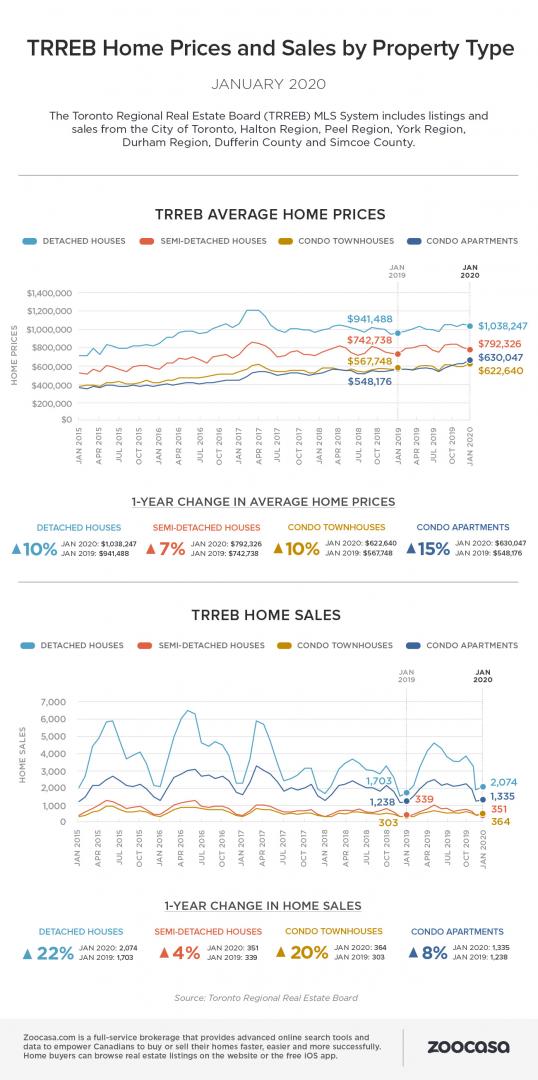

The Toronto Regional Real Estate Board (TRREB) recently announced that GTA realtors reported 4,581 home sales in January 2020 – an increase of 15.4 per cent compared to January 2019.

Sales were up by 4.8 per cent compared to December 2019.

“We started 2020 where 2019 left off, with very strong growth in the number of sales up against a continued dip in the number of new and available listings,” said Michael Collins, TRREB president, in a statement.

“Tighter market conditions compared to a year ago resulted in much stronger growth in average selling prices. Steady population growth, low unemployment and low borrowing costs continued to underpin substantial competition between buyers in all major market segments.”

TRREB says prices are up by 8.7 per cent compared to January 2019 – the highest annual rate of growth since October 2017. Since low-rise homes are already expensive, the condominium segment continued to lead the way in terms of price growth, but TRREB says that all home types experienced price growth above seven per cent.

The average selling price in January was up by 12.3 per cent, driven by the detached and condominium apartment segments in the City of Toronto.

In Mississauga, the average price of a detached home reached $1,187,718 in January. Semi-detached homes cost $817,432, townhouses cost $794,859 and condos cost $539,788.

Real estate website and brokerage Zoocasa says buyers could continue to struggle in 2020.

“If January is any indication, the underlying theme for GTA real estate in the new year will be a supply-and-demand imbalance. Prospective sellers continue to sit on their homes, likely due to a combination of not wanting to list during the winter months as well as waiting out potential promising price appreciation,” says Penelope Graham, managing editor, Zoocasa.

“However, buyers have come early in force to the market, with strong double-digit increases recorded in sales across the Mississauga, Brampton, and Halton regions, with prices following suit. As a result, many local markets are finding themselves in seller-friendly territory, while buyers face increased pressure and competition for available listings.”

Graham says the Mississauga housing market can now officially be considered a sellers’ market, as the city’s sales-to-new-listings ratio (SNLR) hit 61.9 per cent in January.

“That’s up from the firmly-balanced conditions that characterized the market at the same time last year as the trend of rising home sales and declining new supply occurring throughout the GTA are clearly evident here,” Graham says.

Graham says transactions in the city rose 13.7 per cent year over year, while the number of new listings brought to market over the course of the month fell by 11 per cent.

Together, that’s driven the average Mississauga sale price (all home types) to $782,415, up 10.9 per cent year-over-year.

While condos are selling quite rapidly, TRREB says that buyers are eyeing the low-rise market once more, and detached home prices are on the rise as a result.

As for what’s driving buyers back into the market, TRREB says prospective homebuyers have adjusted to the federal stress test (which requires borrowers to qualify at rates higher than what they’ll ultimately be paying).

“A key difference in the price growth story in January 2020 compared to January 2019 was in the low-rise market segments, particularly with regard to detached houses,” said Jason Mercer, TRREB’s director of market analysis and service channels, in a statement.

“A year seems to have made a big difference. It is clear that many buyers who were on the sidelines due to the OSFI stress test are moving back into the market, driving very strong year-over-year sales growth in the detached segment. Strong sales up against a constrained supply continues to result in an accelerating rate of price growth.”

As for what buyers (and sellers) can expect going forward, TRREB’s baseline forecast is calling for strong growth in home sales and selling prices, while the supply of listings is expected to be flat-to-down.

That means that buyers will continue to face stiff competition when searching a home, as supply is simply not keeping pace with demand.

“Robust regional economic conditions, strong population growth and low borrowing costs will support increased home sales in 2020. Market conditions will become tighter, as transactions will continue to outpace the growth in available listings,” Collins said in TRREB’s 2020 market outlook report.

“The resulting increase in competition between buyers will likely result in an acceleration in price growth across all major market segments.”

The report says we should see home sales crest the 90,000 mark in 2020, with a point forecast of 97,000 – up by almost 10.5 per cent compared to 87,825 sales reported in 2019.

The report says sales growth will be driven by the semi-detached, townhouse, and condominium segments.

“These home types are more affordable, on average, and will remain popular as the OSFI mortgage stress test, although under review by the federal government, appears to be remaining in place for the foreseeable future,” the report reads.

The report says that, traditionally, the most popular home type for prospective buyers was the detached house. However, demand has declined markedly since the first survey in 2015 – from 54 per cent in the fall of 2015 to 42 per cent in the fall of 2019. This decline was evident both in Toronto and the surrounding regions.

The report says an increase in buying intentions for condominium apartments and semi-detached homes has accounted for the dip in detached buying intentions.

The report isn’t optimistic about a price drop in 2020, as there simply isn’t enough inventory to satiate demand at this point.

“Unless we see a significant increase in supply, it is highly likely that new listings will not keep up with sales growth in 2020. The end result will be an acceleration in price growth over the next year, as an increasing number of home buyers compete for a pool of listings that could be the same size or smaller than in 2019.”

The report says the point forecast for the overall average selling price in 2020 is $900,000, close to a 10 per cent increase compared to the average of $819,319 reported for 2019.

TRREB also says that If the pace of detached home price growth starts to catch up to that of other major home types, the average selling price for all home types combined could push well past the $900,000 mark over the next year.

Renters will also continue to struggle, as rental supply remains low across the GTA.

As for how to address the problem, the report suggests governments should focus on initiatives that will create more supply.

“After more than three years of slower market activity brought on largely by changes in housing-related policies at the provincial and federal levels, home sales will move closer to demographic potential in 2020,” says Mercer.

The key issue, however, will be the persistent shortage of listings. Without relief on the housing supply front, the pace of price growth will continue to ramp up. Policymakers need to understand that demand-side initiatives on their own will only have a temporary impact on the market.”

The demand for supply-related solutions, the report suggests, is rising.

“During the recent federal election campaign, Ipsos identified affordability issues as being top of mind for Canadians, and central to those concerns are housing costs in Canada and the GTA in particular,” Sean Simpson, vice president at Ipsos, a global market research firm.

“In the coming year, governments will no doubt be focused on how their policies are impacting the delicate balance between housing supply and demand, and how they can best provide relief to Canadians’ pocketbooks in the area of housing costs.”

INsauga's Editorial Standards and Policies