Here’s How Much You’ll be Paying with the First Time Home Buyer’s Incentive in Mississauga

Published September 19, 2019 at 4:10 pm

The federal election is a little more than a month away, and the Liberal party recently announced part of their platform will be geared towards aspiring homeowners.

Known as the First-Time Home Buyer Incentive, the project will assist people who are looking to purchase a house for the first time.

The original proposal would provide assistance for people looking to buy a home for up to $505,263. However, for people looking to buy a house in high-cost areas, such as the GTA, Vancouver, and Victoria this didn’t exactly help, as the majority of houses starting prices exceeded the limit.

However, the new changes will now increase the maximum amount in high-cost areas to $789,473.

The incentive is intended to both assist people who are trying to buy their first home, as well as deter housing speculation from foreign buyers.

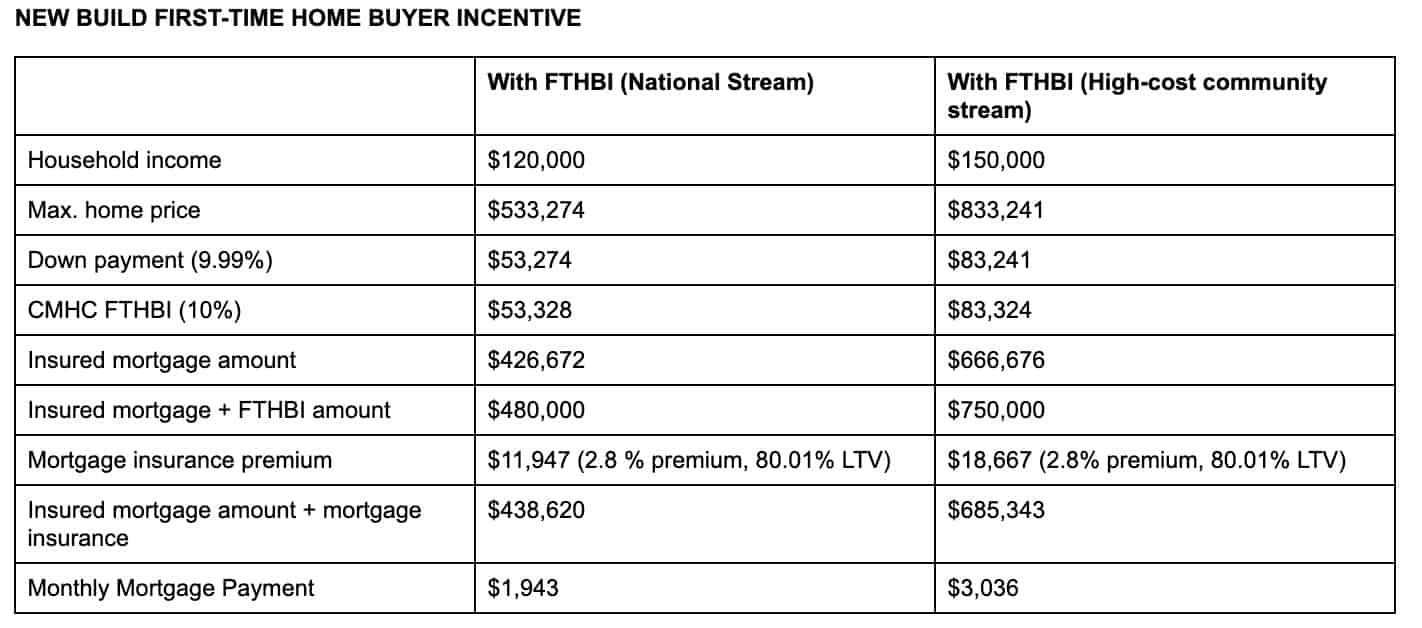

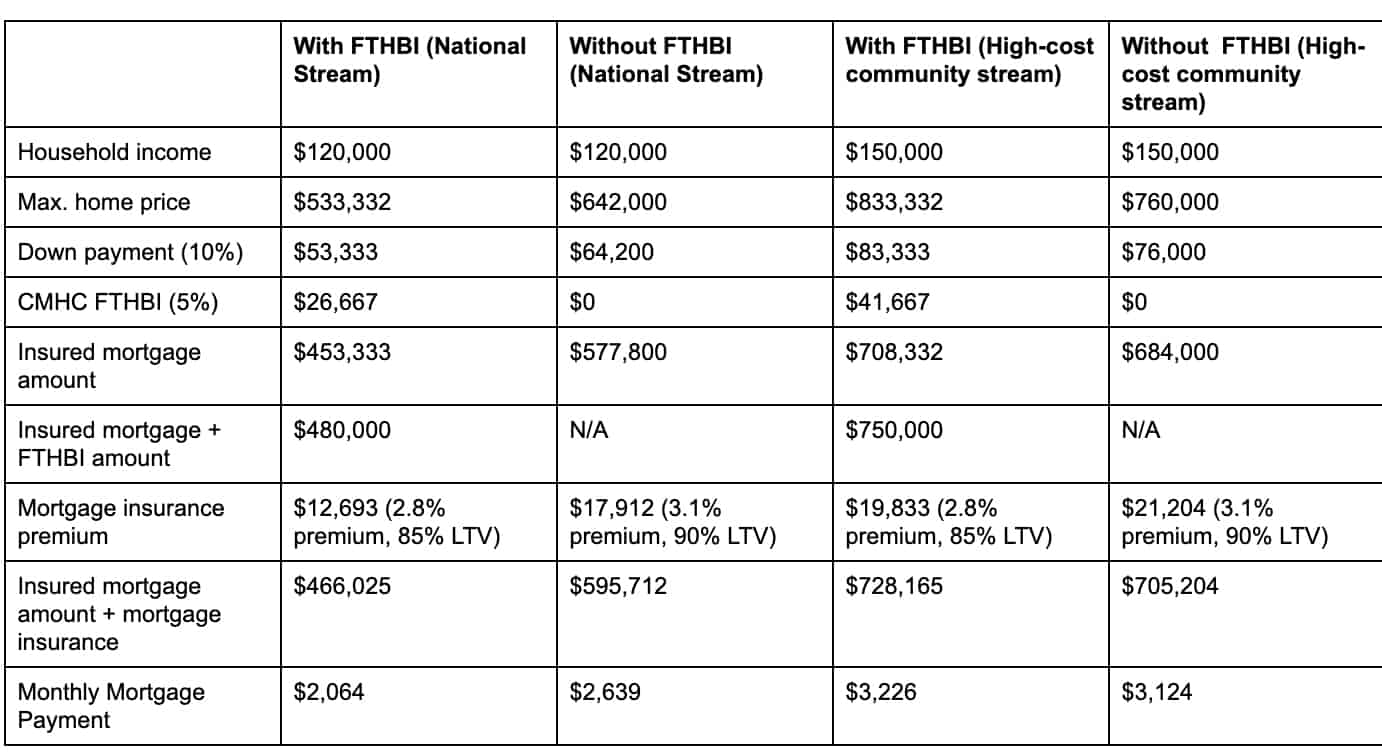

To be eligible for the program, prospective buyers’ household income can’t be more than $150,000 for the high-cost community stream. With the assistance of the government, first-time home buyers can apply for a five or 10 per cent shared equity loan with the government which will allow home buyers to reduce their monthly mortgage payment without increasing their down payment.

When purchasing a home that costs below $500,000, a five per cent down payment is required; however, when purchasing a home that costs between 500,000 and 999,000, a five per cent downpayment that goes towards the first 500,000 plus a down payment of 10 per cent of the remaining cost is required.

Previously this summer, Trudeau tweeted his support of the incentive, encouraging prospective home buyers to take advantage of the new initiative, saying: “Buying your first home is a big step, and we want to make it easier and more affordable. The new First-Time Home Buyer Incentive will help you with your down payment and lower your mortgage–so you can make your dream of owning a home a reality.”

Despite the fact this incentive is being advertised as a way for people to save money, President of CanWise Financial and Co-Founder of Ratehub Inc., James Laird advises prospective buyers not to use the service, saying: “This program is being positioned to first-time homebuyers as a way to save money, which is misleading because it defers the amount that they owe, and doesn’t save them anything. The program will lower a buyers’ monthly mortgage payment, but in exchange, they have a growing debt burden. This burden grows by the amount that your house appreciates, which is often between 5 to 10 per cent per year.”

Laird suggests buyers take advantage of the fact mortgage rates are currently at a historically low rate—less than three per cent for a fixed rate—and borrow more money from a mortgage provider and pay it off over 25 years.

“The program requires home buyers to repay this obligation at the earlier of when they sell their house or 25 years. Those who remain in their home for the full 25-year period can expect the government to knock on their door and tell them that they owe two to three times the initial incentive that they took from the government. These will be people nearing retirement age, and close to paying off their mortgage, but the government’s ownership stake in their house will remain,” he says.

That said, some experts say there are benefits to opting into the program.

Rob McLister, the founder of mortgage rate comparison website RateSpy.com, told BNN Bloomberg that the program could save homeowners more than $3,430 per year in mortgage payments on a $500,000 house.

He also told Bloomberg that buyers who sell or move before their five-year mortgage term is up will likely save money with the program.

“That’s because the interest and default insurance premium savings will likely outweigh the equity give-up,” he told Bloomberg.

INsauga's Editorial Standards and Policies