Here’s How Much House Prices Differ from Neighbourhood to Neighbourhood in Mississauga

Published September 6, 2019 at 8:36 pm

We have officially reached the point where no one can reasonably deny that Mississauga–as well as other major Canadian cities–is facing a housing affordability crisis.

The once affordable alternative to Toronto has become increasingly more expensive. As the city has grown and urbanized (and there’s nothing wrong with either urbanization or growth, to be clear), it’s become virtually impossible for residents to find a low-rise home for under $500,000.

According to data from the Toronto Real Estate Board, the average home price in Mississauga (all home types combined) reached $732,549 in August 2019. Homes aren’t just expensive either—they’re rare. In fact, real estate website and brokerage Zoocasa says recent data indicates that Mississauga is officially a sellers’ market, as new listings aren’t keeping up with demand.

The situation isn’t any better for tenants, either.

Data from the recently released August 2019 Rent Report, produced by Rentals.ca and Bullpen Research & Consulting, indicates that Mississauga continues to be expensive for renters as the city finished third of 37 cities listed for average rent for a one-bedroom at $1,933 and fourth for average monthly rent for a two-bedroom at $2,232.

The rental situation–compounded by low inventory and ferocious competition between prospective tenants–does not appear to be improving (although Mississauga is working to implement a plan that will, ideally, spur the creation of more rental units).

But while homes—and even condos—are unlikely to become affordable (meaning shelter costs will only amount to 30 per cent of a household’s takehome pay) in the future, there are some neighbourhoods that boast less costly real estate.

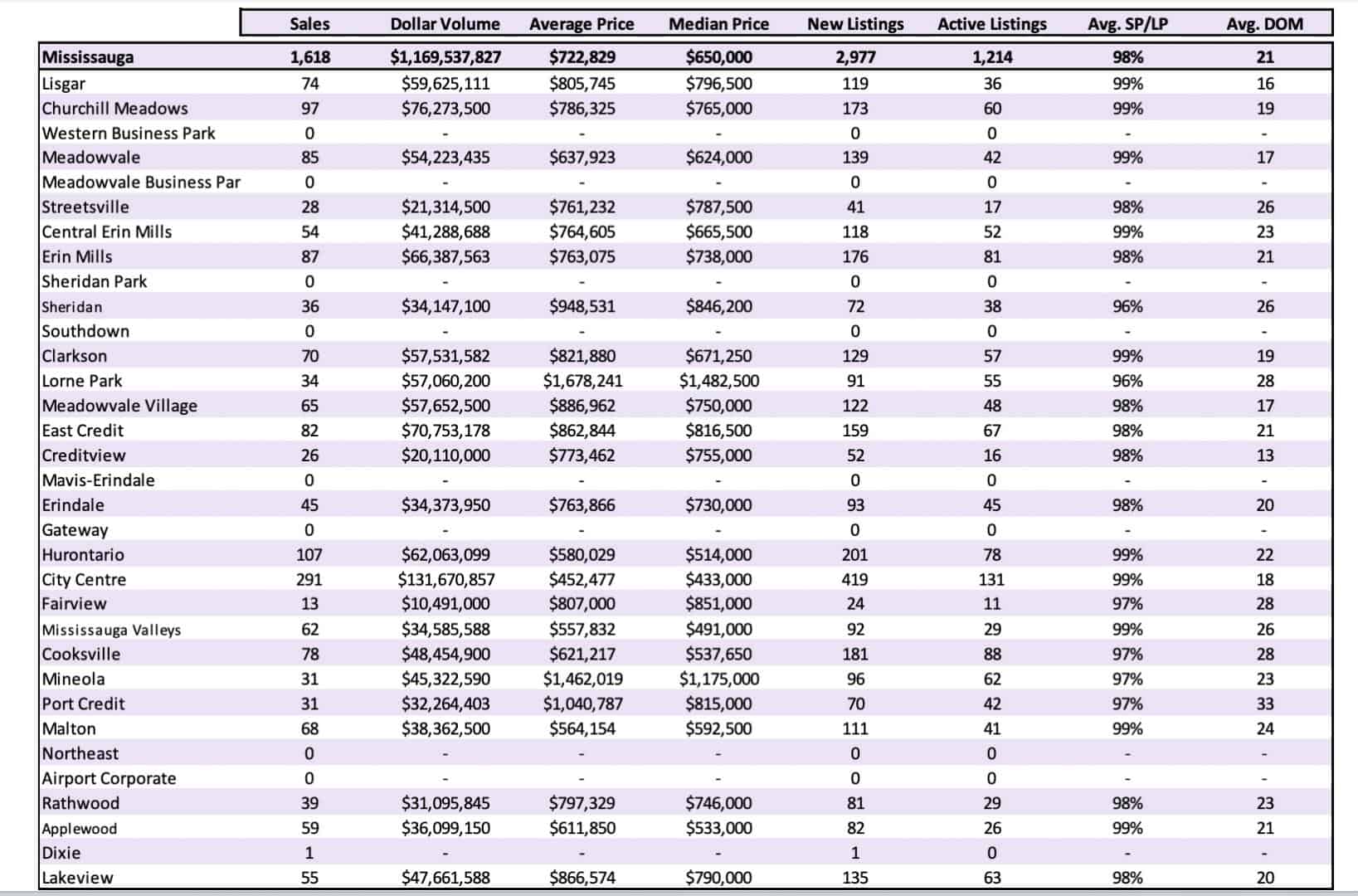

Nikhil Oberoi, a sales representative with Cloud Realty, recently supplied insauga.com with some data that shows just how expensive some neighbourhoods are compared to others.

Here’s a look at the average house price (all home types combined) in various Mississauga neighbourhoods:

- Applewood: $611,850

- Central Erin Mills: $764,605

- Churchill Meadows: $786,325

- City Centre: $452,477

- Clarkson: $821,880

- Cooksville: $621,217

- Creditview: $773,462

- East Credit: $862,844

- Erin Mills: $763,075

- Erindale: $763,866

- Fairview: $807,000

- Hurontario: $580,029

- Lakeview: $866,574

- Lisgar: $805,745

- Lorne Park: $1,678,241

- Malton: $564,154

- Meadowvale Village: $886,962

- Mineola: $1,462,019

- Mississauga Valleys: $557,832

- Port Credit: $1,040,787

- Rathwood: $797,329

- Sheridan: $948,531

- Streetsville: $761,232

You can see a graph with a little more data here:

Not unexpectedly, the neighbourhoods with the highest average home prices are Clarkson, East Credit, Lakeview, Lorne Park, Meadowvale Village, Mineola, Port Credit, and Sheridan.

More affordable neighbourhoods—where average home prices currently sit around or below $600,000—include Applewood, City Centre (likely because of the prevalence of condos as opposed to low-rise homes), Hurontario, Malton and the Mississauga Valleys.

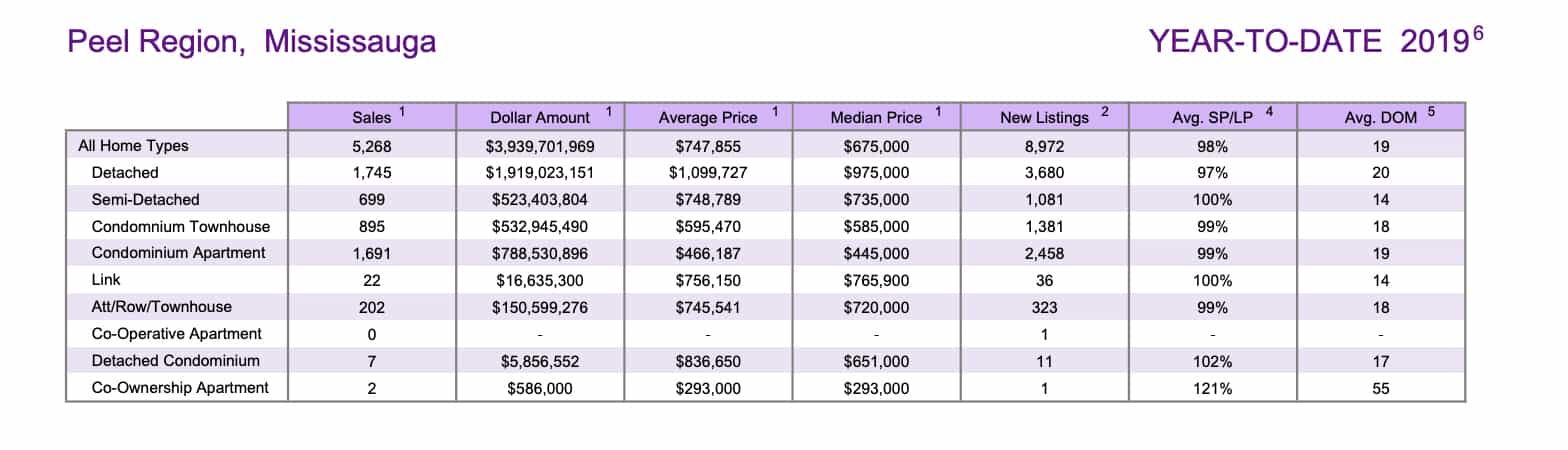

But while the average home prices might not look too intimidating in some neighbourhoods, buyers should note that some home types are significantly more expensive than others. In Mississauga, the average detached home costs $1,099,727. Semi-detached homes are more affordable, coming in at $748,789 on average. Condo townhouses typically cost $595,470, while condo apartments cost $466,187. A row/townhouse costs about $745,541, which isn’t that much less than a semi.

But while the average home prices might not look too intimidating in some neighbourhoods, buyers should note that some home types are significantly more expensive than others. In Mississauga, the average detached home costs $1,099,727. Semi-detached homes are more affordable, coming in at $748,789 on average. Condo townhouses typically cost $595,470, while condo apartments cost $466,187. A row/townhouse costs about $745,541, which isn’t that much less than a semi.

Are you having trouble affording a house in Mississauga?

INsauga's Editorial Standards and Policies