Brace for more home insurance rate increases in Ontario and across Canada: report

Published March 5, 2024 at 1:57 pm

Canadians should brace for higher home insurance rates in the coming year.

Inflation and increased climate-related disasters mean Canadians should be ready for a “significant shift” in insurance costs, according to a report from insurance comparison website MyChoice.

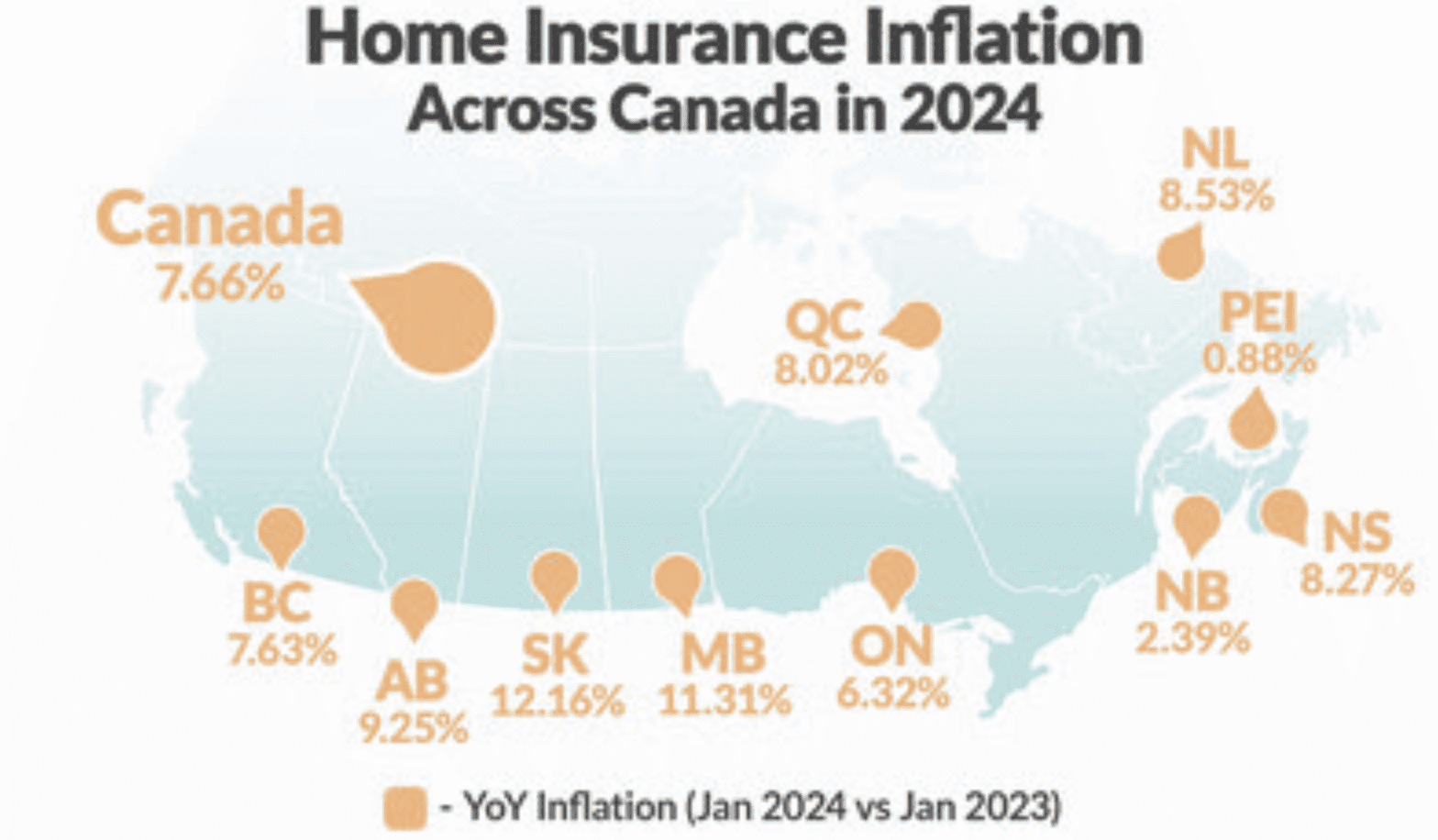

Home insurance prices have already increased 7.66 per cent year-over-year in January, according to the report.

And even though inflation is expected to level off in 2025, high repair and replacement costs continue to impact rates. More claims due to climate change events such as forest fires and floods have “set the stage for this inevitable price recalibration.”

“The undeniable influence of climate change on the frequency and severity of natural disasters in Canada serves as a critical backdrop for the projected increases in home insurance rates,” the report states.

“Each year, the insurance industry grapples with the growing challenge of covering losses from wildfires, floods, and other climate-related events, necessitating a recalibration of rates to keep pace with this escalating risk.”

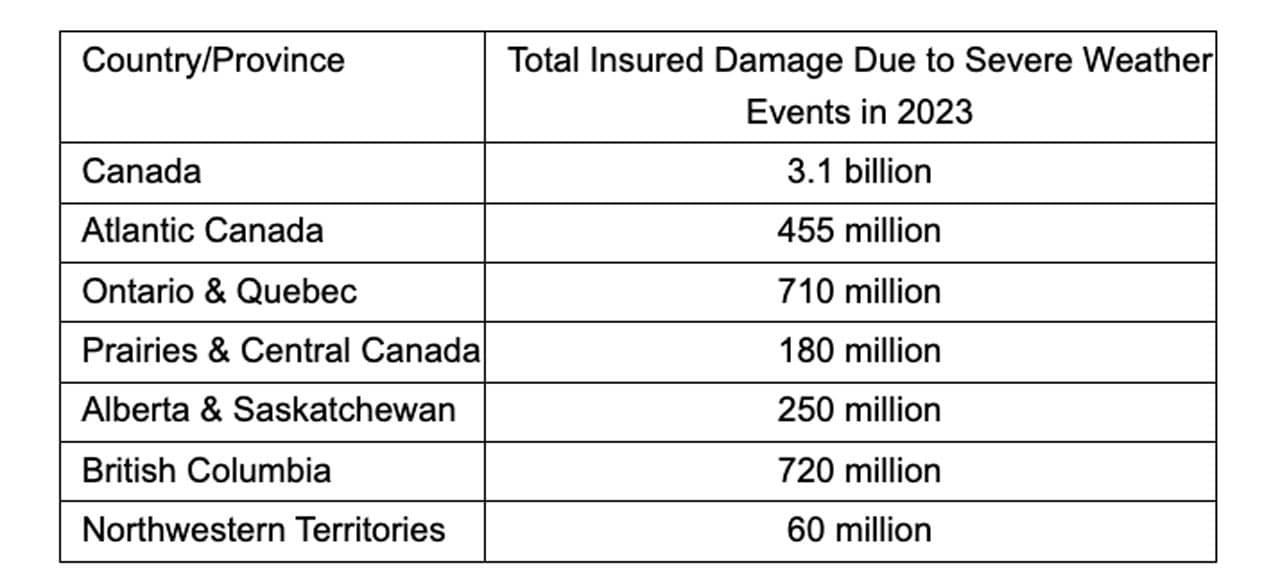

According to the latest report from the Insurance Bureau of Canada, severe weather conditions in 2023 caused over $3.1 billion in insured damage across the country.

Some provinces have seen higher rate increases than others.

Regions with higher insured damages, such as BC with $720 million and Ontario and Quebec combined with $710 million, likely contribute to the broader trend of increasing insurance rates due to the higher risk and cost of claims associated with these events.

There is some help out there.

The federal government committed $31.7 million toward the national flood insurance program in its 2023 budget to combat the rise in insurance premium calls. The program aimed to reduce the socio-economic impact of floods, which have historically been a big problem for Atlantic Canada, notably with Hurricane Fiona causing significant damage to the region in 2022.

But combined with high mortgages and an overall increase in the cost of living, the financial pressures for homeowners may contribute to an already alarming mortgage delinquency rate, the report notes.

This is particularly concerning given that 52 per cent of Canadians are $200 or less away from financial insolvency, according to MNPs recent consumer index reports.