Average rent hits record high as Brampton ranked 9th-most expensive city in Canada for July

Published August 11, 2023 at 2:12 pm

The national average price for rentals across Canada jumped again last month reaching record highs, including a more than 25 per cent increase in Brampton compared to July of 2022.

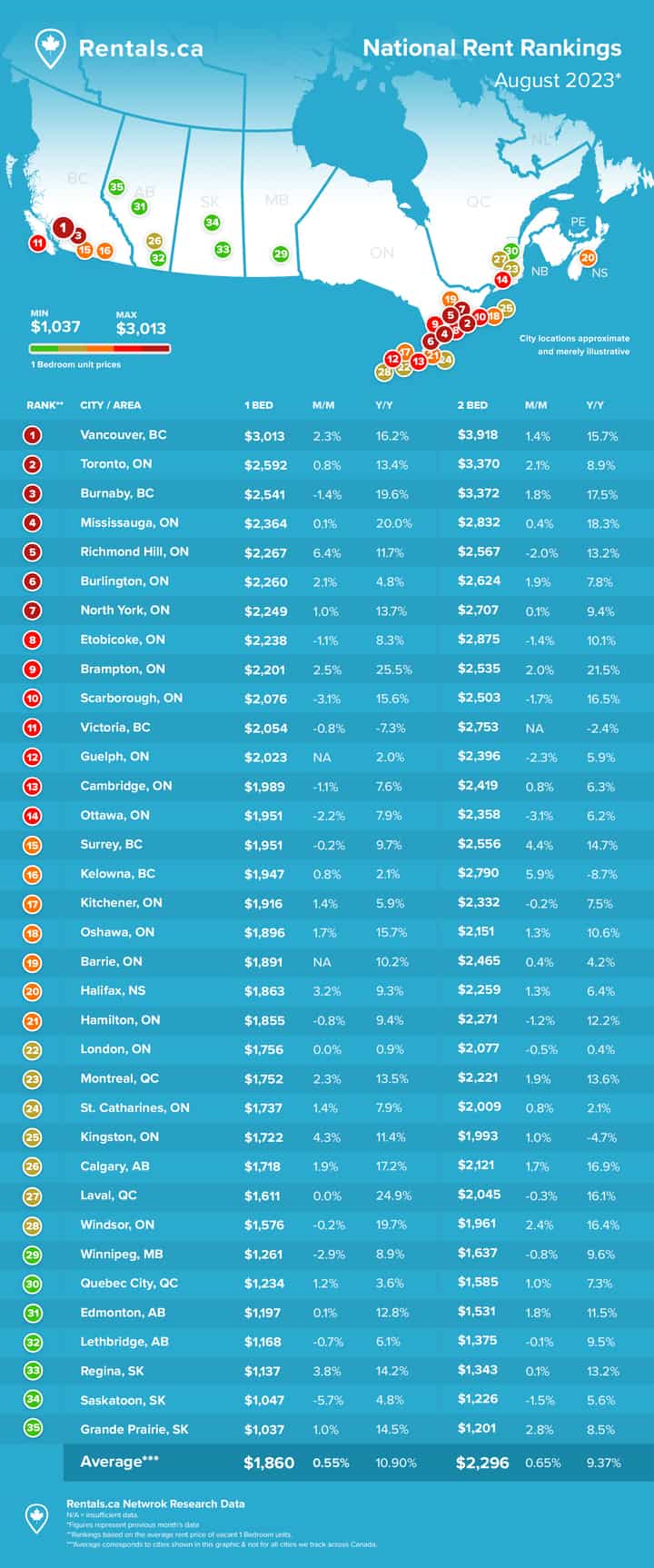

The numbers come from the latest national rent report which looked at the rental rates in 35 Canadian cities from coast to coast for the month of July.

Brampton cracked the top 10 of the most expensive cities to rent coming in at No. 9, and had the single largest increase in rental rates compared to the same time last year.

Year over year, the average monthly rent in July for a one-bedroom in Brampton was up 25.5 per cent at $2,201 per month, while two-bedroom units saw a spike of 21.5 per cent to $2,535. The city also led the province in rent growth, with the average asking rents for purpose-built and condominium apartments increasing by 18.6 per cent.

Other, more expensive Ontario cities in the top 10 include Etobicoke with an average one-bedroom monthly rental coming in at $2,238, North York at $2,249, and Mississauga at No. 4 on the list at $2,364 for a one-bedroom and $2,832 for a two-bedroom rental.

Nationally, the average asking rent in Canada reached a new high of $2,078 in July, representing an 8.9 per cent annual increase and the fastest pace of growth over the past three months, according to the report from real estate websites Rentals.com and Urbanation.

Across Canada the average asking rents for purpose-built and condominium apartments rose above $2,000 for the first time in July, reaching $2,008 last month.

“Canada’s rental market is currently facing a perfect storm of factors driving rents to new highs,” said Shaun Hildebrand, president of Urbanation. “These include the peak season for lease activity, an open border policy for new residents, quickly rising incomes, and the worst ever homeownership affordability conditions.”

The report found rents across Canada saw even more upward pressure last month as post-secondary students rushed to sign leases ahead of the fall term, a record level of population growth, and homebuyers “moved to the sidelines” due to the Bank of Canada raising interest rates to a 22-year high.

INsauga's Editorial Standards and Policies