6 scams that hit Ontario this month

Published January 21, 2024 at 12:05 pm

Fraudsters are continually devising new schemes, targeting vulnerable individuals through texts, emails, or calls.

These criminals will use various tactics to persuade victims to send funds under the guise of service providers threatening customers with potential cutoffs, or package delivery issues, and even bank account deactivations.

Here are the latest scams circulating in Ontario:

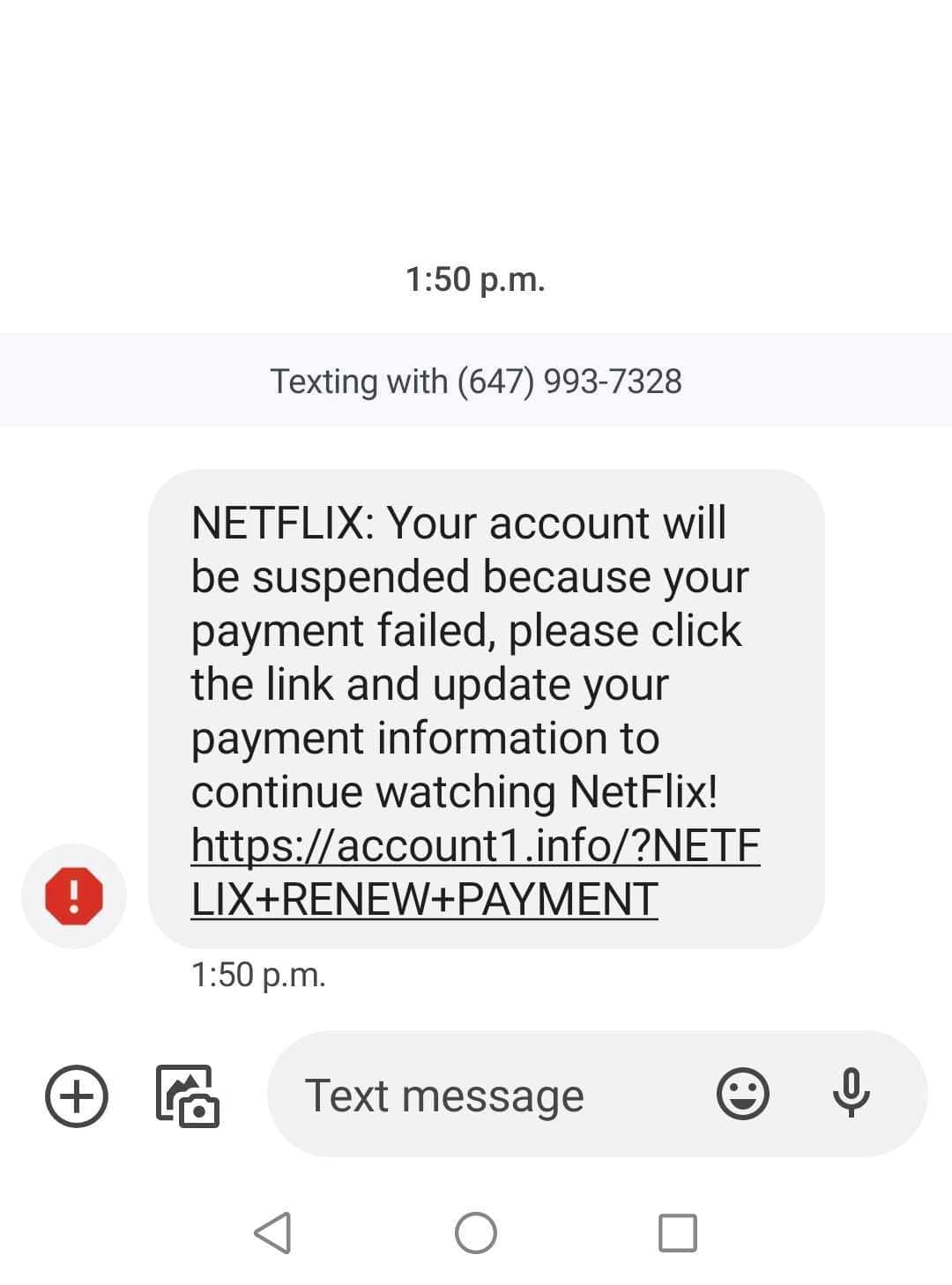

Netflix account scam

As you settle in for the latest movie or binge-watching session, an unexpected message on your phone warning of a streaming service account suspension can quickly turn a relaxing moment into a stressful one.

In this scenario, the scammer pretends to be the service provider Netflix.

“Your account will be suspended because your payment failed,” the message says. “Please click the link and update your payment information to continue watching.”

The Canadian Anti Fraud Centre (CAFC) says, this particular scam is known as “phishing.”

Fraudsters use tactics like email and website spoofing, creating a sense of urgency. Impersonating reputable entities, they may offer refunds or request victims to click on links, download attachments, or fill out forms.

These deceptive messages aim to trick individuals into divulging personal or financial information.

Phishing crimes often lead to identity theft or ransomware, where scammers demand money for account or computer access. The CAFC warns against visiting links, as they may infect computers with viruses or malware.

Impersonating fraud prevention companies (CAFC)

In a twist of irony, the Canadian Anti-Fraud Centre (CAFC), a reputable source for alerting the public to emerging scams, has become the target of the latest impersonation scheme.

Scammers, under the guise of fraud prevention will call, text, fax, or email to falsely seek assistance in catching a bank employee stealing money or resolving suspicious transactions in your bank account.

Adding to the deception, fraudsters use CAFC letterhead and logo to lend credibility to their scams.

The CAFC recommends residents follow these protective measures to avoid falling victim to such scams:

- Avoid Dialing *72: This forwards calls to fraudsters.

- Common Card Digits: Fraudsters may share the first 4 digits of your debit/credit card. Individuals are reminded that most debit and credit card numbers belonging to well-known financial institutions begin with the same 4 numbers.

- Early Morning Calls: Be cautious of calls from bank investigator fraudsters in the early morning targeting less alert victims.

- No Fund Transfers: Financial institutions or online merchants won’t request fund transfers to external accounts for security reasons.

- Card Handover: Institutions or police won’t ask for you to handover your bank card at your place of residence.

- Call-Spoofing: Criminals use call-spoofing to mislead victims; don’t trust displayed phone numbers.

- No Remote Access: Never grant remote computer access to unknown people.

- Verify Callers: If a call claims to be from your financial institution, insist on calling back using the official number on your card.

- Independent Verification: End the call and dial the number on your card from a different phone or wait 10 minutes before calling back.

Canada Revenue tax scam

The Canada Revenue Agency (CRA) warns the public about these scams and to be cautious if anyone contacts them claiming to be from the CRA.

Red flags include requests for personal information like social insurance numbers, credit card numbers, or bank account details, often received through text messages, mail, or phone calls.

The CRA emphasizes that legitimate employees will provide their name and phone number for verification.

The CRA will never demand immediate payment, set up public meetings for payments, or use aggressive language. Additionally, they don’t send emails or texts with refund links or request personal/financial details online.

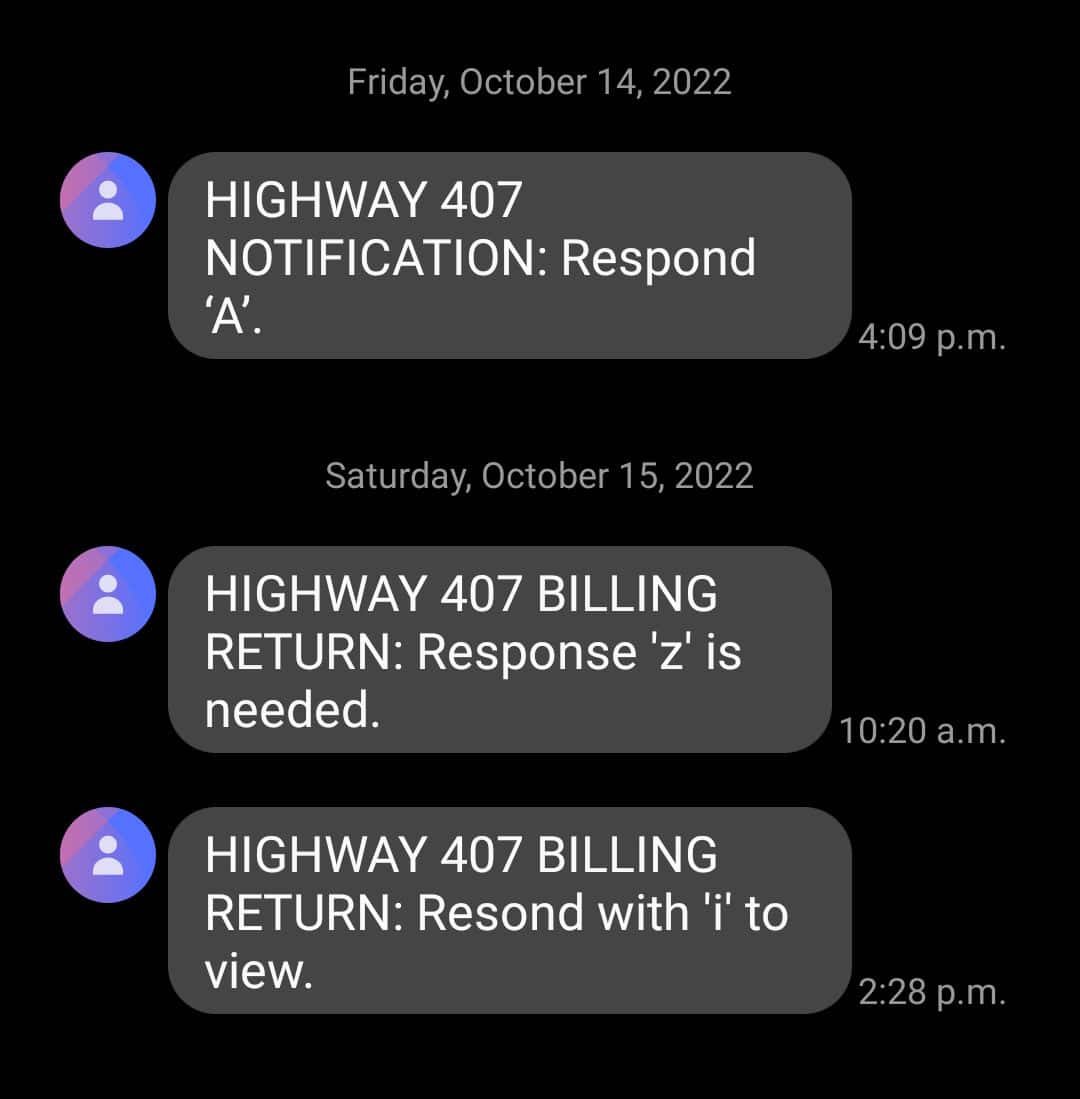

Highway 407 ETR scam

If you’re a frequent driver on major highways, particularly those with tolls, then this is a scam to look out for.

Highway 407 ETR recently issued a warning about scammers sending fake payment requests via text messages.

The official statement urges people not to click on any links, clarifying that 407 ETR only sends text messages for payment reminders, accompanied by a secure webpage link for payments.

Reports also highlight phishing attempts by scammers seeking personal information.

Recipients unsure of a messages authenticity can verify by visiting http://407etr.com/contactus.

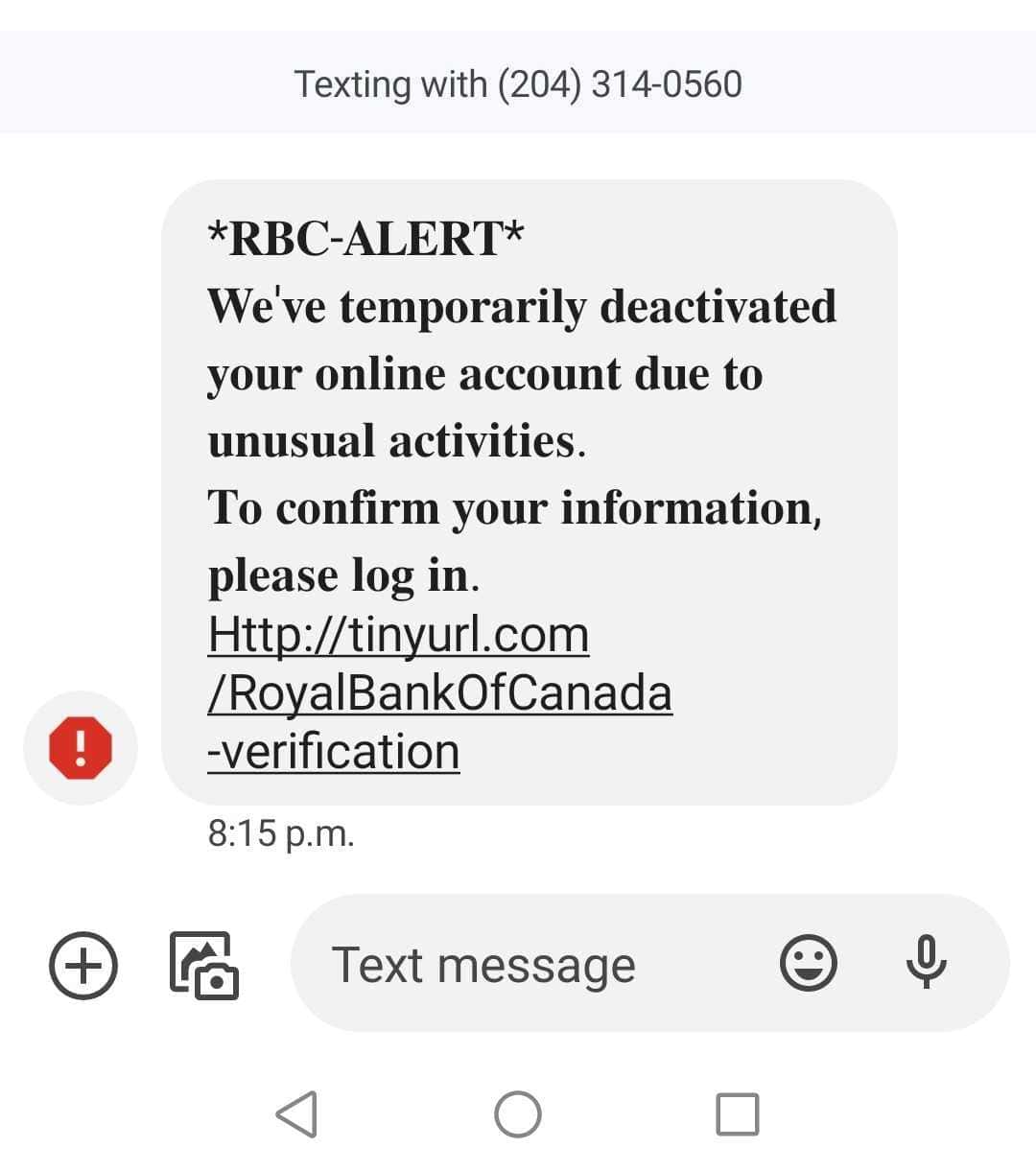

Bank account deactivated scam

A scam in the form of a text claiming to be from the Royal Bank of Canada (RBC), informs recipients of a temporary account deactivation due to unusual activity.

The message prompts users to confirm information by logging in and provides a link in the text.

RBC warns customers of fraudulent SMS messages from cybercriminals attempting to extract personal or financial details.

The bank advises clients to contact them directly through official phone numbers or the website to address any account-related concerns and avoid falling victim to such scams

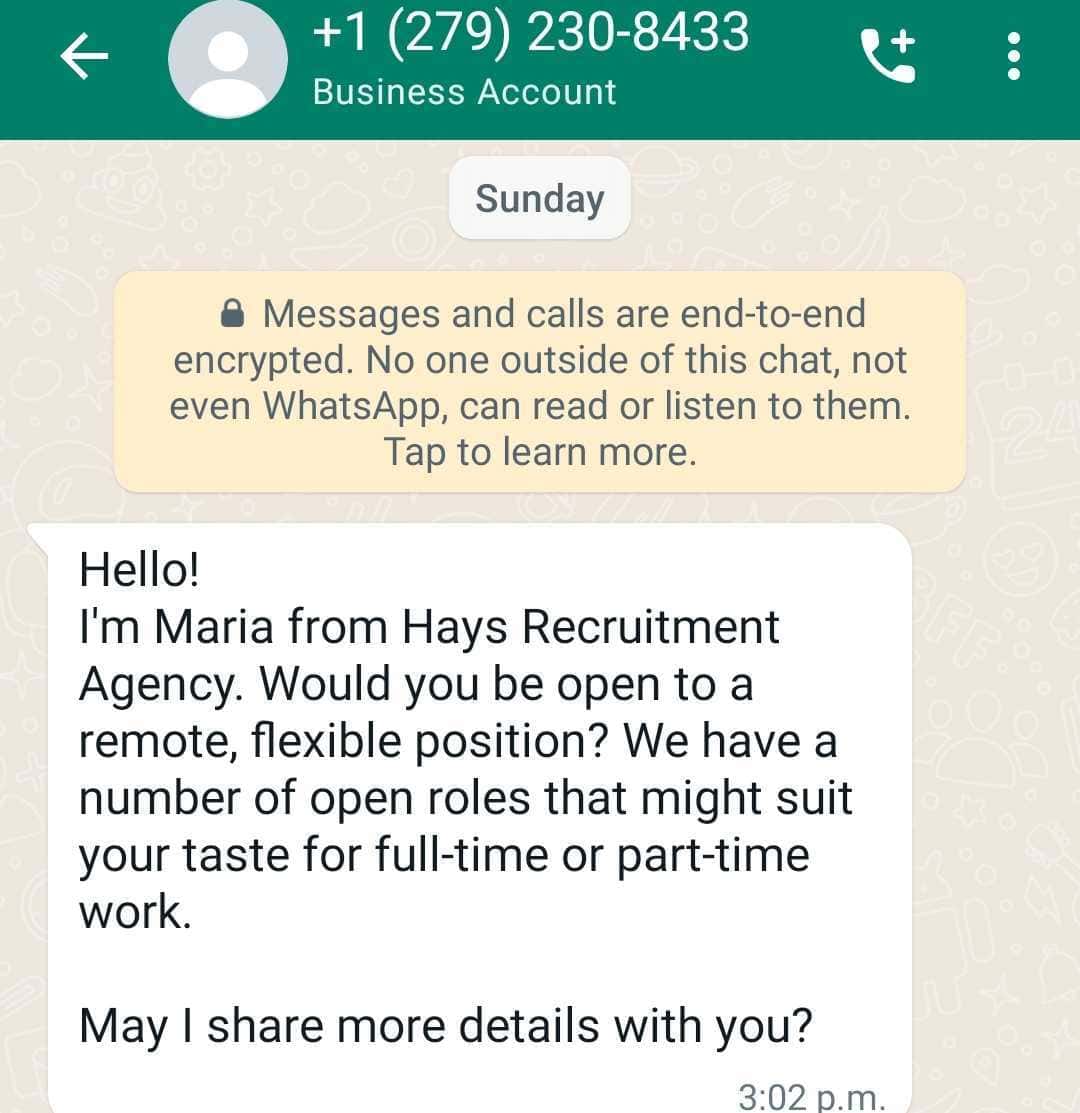

Job recruitment scam

Scammers will use the messaging platform WhatsApp to approach potential victims, posing as fictitious recruiters from legitimate companies like ‘Hays Recruitment,’ in Toronto.

The trickster will offer remote job opportunities, exploiting victims by promoting products or videos through software.

However, recipients of the message should note the phone number of the sender.

In this case, the use of a Sacramento, California area code (279) may raise suspicions.

The Canadian Anti-Fraud Centre warns of an increase in such scams since August 25, 2023.

Individuals are advised to block the number, refrain from responding to the message, and avoid providing personal information.

Package delivery scam

Fraudsters will send a text message posing as the a Canadian postal service, falsely informing recipients that their item has reached the warehouse, but cannot be delivered due to an incomplete address.

The fraudulent message then urges individuals to confirm their address by clicking on a provided link.

According to the Canadian Anti-Fraud Centre (CAFC) this is an example of “smishing,” which is a variation of phishing schemes.

Canada Post mentions on their website that they see similar messages circulating the region frequently and are reminding their customers that they do not send out such messages and should be deleted.

“We will never reach out to you by text message to request credit card or banking information, account information such as your password, or payments to release deliveries and/or see updated tracking information,” Canada Post states on their website.

“Messages will only come from sender IDs 272727 or 55555 and only if you’ve signed up for notifications,” the postal service adds.

INsauga's Editorial Standards and Policies