Home sales down 44.6% as average home price is $977,016 in Mississauga

Published February 3, 2023 at 10:29 pm

If you’re looking to buy a house in Mississauga, you’ll notice more inventory and lower (but certainly not low) listing prices.

Real estate website and brokerage Zoocasa says that significantly more houses hit the market in Mississauga in January 2023 compared to December 2022. Data from the Toronto Regional Real Estate Board (TRREB) indicates that 634 homes were listed, up 89 per cent from the 335 that hit the market at the end of last year.

As far as price points go, data indicates the average price in the city sits at $977,016–still a little bit shy of the $1 million mark.

Zoocasa says that buyers are gravitating towards more affordable property types, particularly those priced under $800,000. Homes that fall under that category include semi-detached houses, townhouses and condos.

According to TRREB, 108 condos changed hands in the city, while 76 detached homes sold. Twenty-seven semi-detached homes were sold, and few townhouses changed hands–just seven units.

As far as price points go, TRREB data indicates that the average price of a detached house in the city hit $1,379,588 in January. Semi-detached houses cost $960,178, townhouses cost $1,045,429, condo townhouses cost $797,702 and condo apartments hit $626,401.

According to Zoocasa, 282 homes sold in the city in January, and homes are sitting on the market for an average of 45 days–a little longer than the Toronto Region average of 41 days and the Peel Region average of 42 days.

“As the most recent Bank of Canada rate announcement gave buyers and sellers alike some hope that rates may be held in the future, sideline buyers are finally entering the market again, and sellers are taking notice,” Claudio Castro, managing broker, Zoocasa, said in a statement.

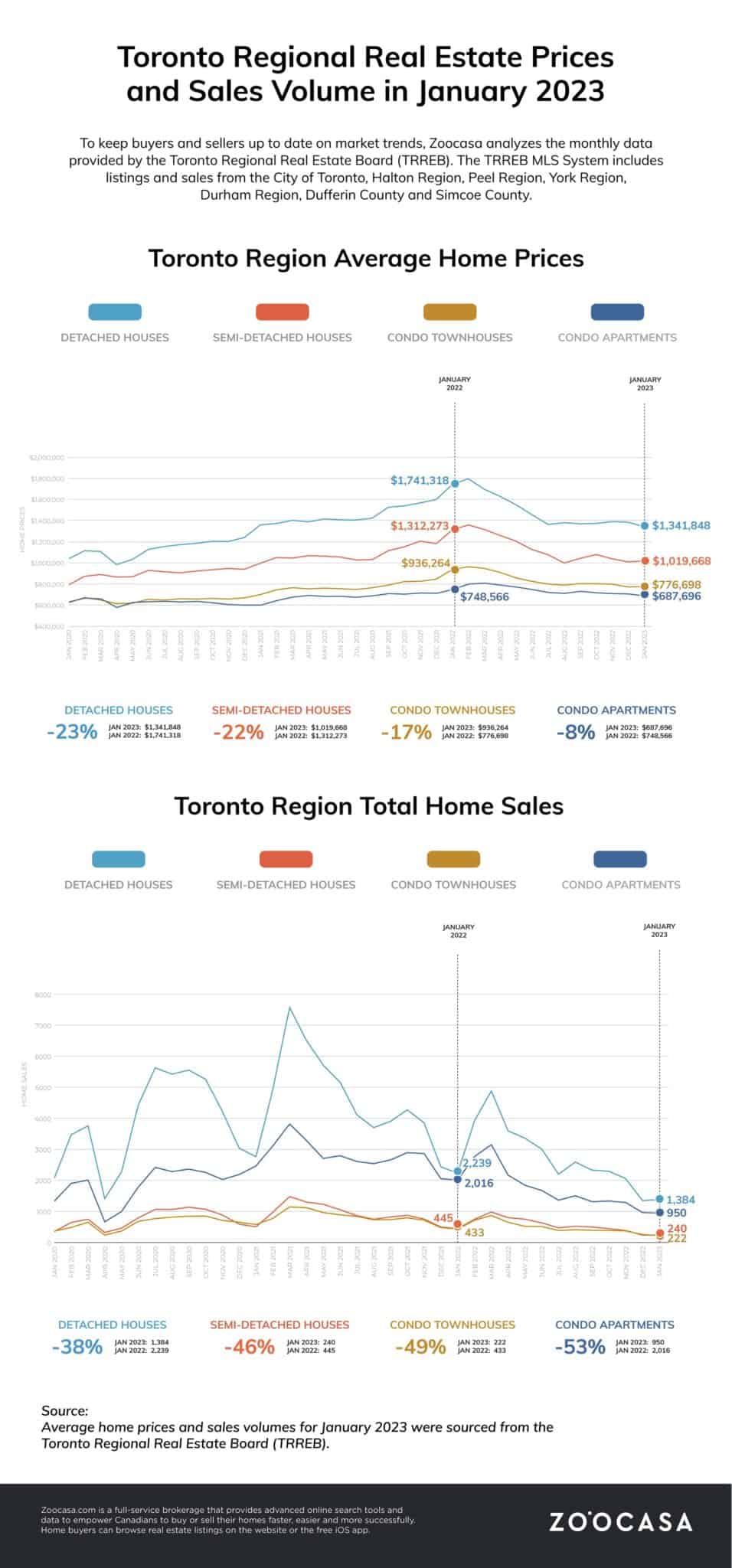

As for the GTA overall, home sales are down year-over-year, with 3,100 sales reported in January–down 44.6 per cent from January 2022. The average selling price for January 2023 sat at $1,038,668, down 16.4 per cent compared to the average price recorded in January 2022.

As for what’s driving prices down, eight Bank of Canada interest rate hikes have cooled the market by making prospective buyers hesitant to purchase residential real estate.

“Home prices declined over the past year as homebuyers sought to mitigate the impact of substantially higher borrowing costs,” said Jason Mercer, TRREB Chief Market Analyst, in a news release.

“While short-term borrowing costs increased again in January, negotiated medium-term mortgage rates, like the five-year fixed rate, have actually started to trend lower compared to the end of last year. The expectation is that this trend will continue, further helping with affordability as we move through 2023.”

That said, some experts expect demand for housing to remain high–especially as more new Canadians move in.

“Home sales and selling prices appear to have found some support in recent months. This coupled with the Bank of Canada announcement that interest rate hikes are likely on hold for the foreseeable future will prompt some buyers to move off the sidelines in the coming months,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

“Record population growth and tight labour market conditions will continue to support housing demand moving forward.”

INsauga's Editorial Standards and Policies